过去三年,Multicoin Capital 通过旗下的对冲基金和风险基金,在 Jito Network 原生代币 JTO 上获得了相当大的持仓。

以下是我们 45 页资产报告的执行摘要。您可以点击“阅读完整报告”按钮,下载完整的报告和分析,包括我们的估值模型和价格目标。

执行摘要

Jito 已成为 Solana 经济机器的重要组成部分,我们认为其系统是 Solana 网络上处理交易和生成区块的关键基础设施。 我们对 Jito(及其原生代币 JTO)的信心,深深植根于 Jito 在质押者、验证者、前端和用户之间创建的结构性锁定机制,以及其在交易供应链中的主导地位。 简而言之,它处于一个让 Solana 保持高效运转的多边网络的核心位置。

如今,Jito 是一个集成软件系统,由三个核心部分组成:

交易处理和区块生成架构(即 Jito-Solana 验证者客户端,以及相关产品中继器 (Relayer)、分片流 (Shredstream)、区块引擎 (Block Engine)和交易打包 (Bundles)); 质押架构(即 JitoSOL,Jito 的流动性质押代币,以及 Stakenet,Jito 自主、去中心化的质押委托算法);以及 再质押架构(即节点共识网络,包括小费路由器 (TipRouter)和保险库 (Vaults))。

我们已经将 MEV 作为并编写了,广泛地将 MEV 视为资产账本估值的框架。 在整个 2024 年,MEV 获取和再分配让堆栈不断升级。 我们预计这一趋势将在可预见的未来持续下去。 随着加密货币市场结构的成熟,我们认为 JTO 将是这一发展趋势的最大受益者之一。

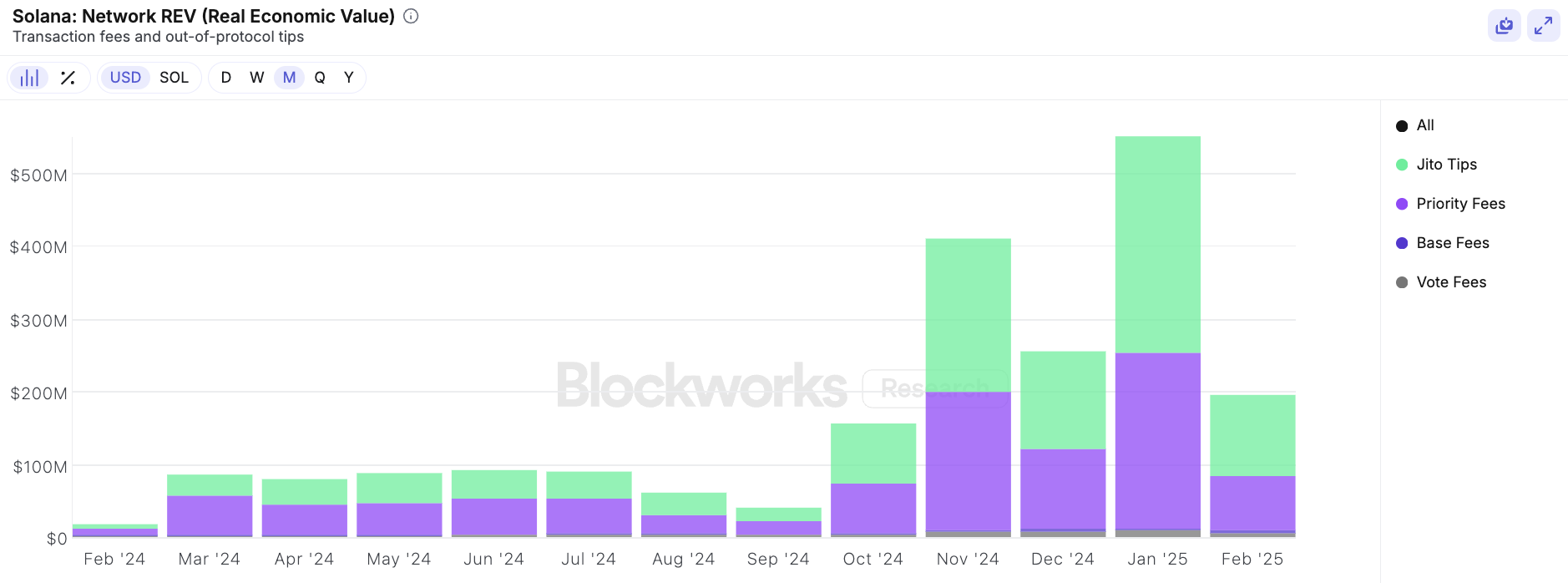

目前,Solana 是使用最广泛、生产力最高的公链网络,从 2024 年第四季度开始,其在交易收入(数据来自 Dune Analytics,图表不包括小费)和交易量(数据来自 DefiLlama)方面,一直远远超过所有其他主要区块链网络。从那时起,Solana 的 REV(实际经济价值)随着数十亿交易量的增长而大幅提升,而且 Solana 上超过一半的交易费用都是通过 Jito 系统处理的。

数据来源:Blockworks Research,2025 年 3 月 3 日

数据来源:Blockworks Research,2025 年 3 月 3 日

除了价值获取使堆栈不断升级之外,我们认为 JTO 是获得针对 Solana 上互联网资本市场。

围绕激烈竞争状态的交易执行,对于无需许可、高性能的分布式资产账本的正常运作至关重要。 Solana 要实现其“纳斯达克速度的区块链” 这一最初愿景,唯一的途径就是以低延迟处理大量的入站流量和出站流量。 Jito 在这方面发挥了关键作用,它根据时间偏好对 Solana 的交易进行细分,同时稳定网络,并防止因对交易纳入的巨大需求而导致的网络拥塞。

随着系统的扩展,Jito 的一系列产品在维护 Solana 上用户体验方面发挥了重要作用。 在撰写本文时,Solana 上超过 94%都运行着 Jito-Solana 客户端,该客户端在市场高波动事件期间,以持续较低的中位数费用,为交易确认提供了急需的可靠性。 我们认为,这为应用层带来了指数级增长的可能——支持了像高性能衍生品交易所(能够优先处理做市商撤单,从而实现更窄的点差,如Drift)、依赖大规模低成本代币转移的去中心化物理基础设施网络 DePIN(如io.net、Render、Hivemapper、GEODNET 和 Helium)、新的现货资产发行和交易平台(如Jupiter、Clearpools 和 Backpack)等应用场景。

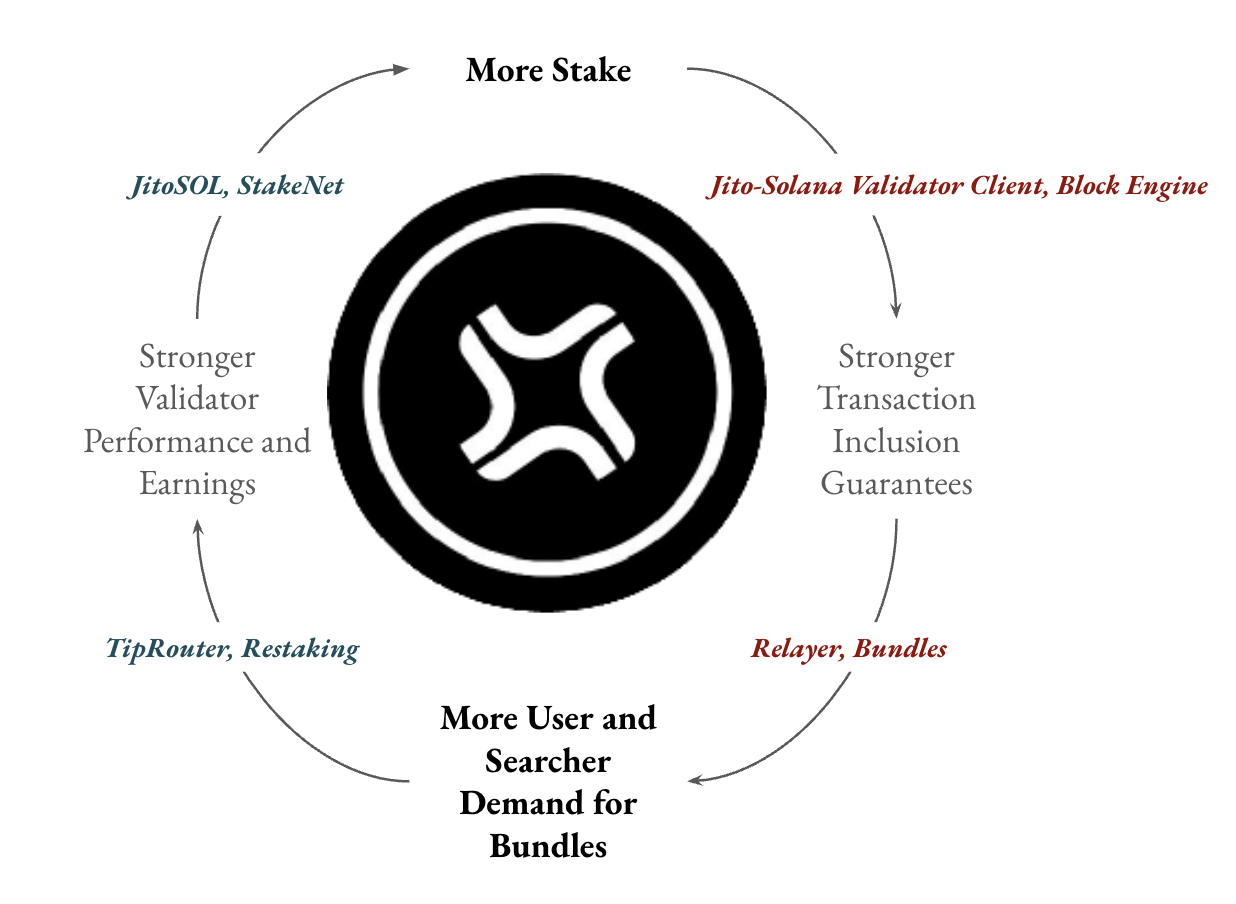

Jito 的每一项产品都互相促进。 StakeNet 质押委托系统和 JitoSOL 质押池鼓励验证者运行 Jito-Solana 客户端。 运行 Jito-Solana 客户端使验证者能够通过构建更具盈利性的区块,赚取更高的收益并分配给质押者。 再质押有助于使收益分配去中心化,同时为 JitoSOL 和 JTO 增加独特的效用,进一步激励用户使用,同时为质押者带来额外收益。

作为 Solana 上 MEV 获取和分配的核心,我们预计 Jito 将在 Solana 产生的经济价值中占据越来越大的份额——交易打包小费、质押奖励和再质押收益提供了多种价值累积途径。 根据本报告估值部分所讨论的假设和模型,我们针对 JTO 的乐观目标价格为 11.63 美元,是截至 2025 年 3 月 3 日 7 天时间加权平均价格 (TWAP) 2.61 美元的 4.43 倍。

Jito 是 Solana 爆炸式增长的主要受益者,其代币是 JTO。

披露:查看我们的报告在模型中包含的假设,对于理解我们确定此目标价格的依据,以及在乐观目标价格之外取得其他成果的潜力非常重要。

/机器人在哪里?

我们很高兴在今天宣布,Multicoin 主导了一项战略行动,以 800 万美元向 Geodnet 基金会收购 Geodnet 网络的原生代币 GEOD。

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.