Trade-offs in the Decentralized Exchange Space

Note: This essay assumes an understanding of crypto derivatives and the major DeFi protocols.

One of the greatest innovations of modern financial markets is that traders can gain financial exposure to an asset without having to physically settle that asset—aka synthetic exposure. This dramatically expands the universe of traders who can trade in a given market, especially for harder to deliver assets. This is desirable because increasing traders and capital in a given market can help reduce volatility and increase liquidity.

We believe that the largest and most lucrative opportunity in DeFi is to create a protocol that allows anyone in the world to trade any asset. We have been referring to this idea as “Decentralized Exchange” internally for over a year. The idea of a decentralized exchange protocol that enables synthetic assets is compelling for several reasons. It offers:

- No centralized exchange operator, therefore lower fees in the long run

- Permissionless access across borders

- Censorship resistance such that no one can shut down the exchange

- No counterparty risk because users hold their own funds

- No withdrawal limits and/or trading size limits

- No way to change the rules of the exchange unilaterally

- Any asset with a public price feed can be traded

Centralized crypto exchanges today process $3B / day of cumulative spot volume, and $13B / day of derivatives volume. For context, global equity trading worldwide was $32T USD in Q1 2020. Global FX trading volumes reached $6.6T / day in late 2019. A permissionless synthetic asset exchange built on crypto rails would allow anyone on the planet with an internet connection to gain exposure to any financial asset. This would expand the market for asset exposure in the same way that Uber expanded the market for taxis.

There are a number of teams in DeFi working to build decentralized exchanges. These teams are taking different approaches to their protocol and contract designs. In this essay we explore the design space for a decentralized exchange and the choices made by the prominent teams trying to build this future. We focus primarily on financial constructions rather than technical architectures; this essay is about finance, not software.

Objectives for Synthetics Trading

The primary objectives for a decentralized exchange protocol are:

- Having very liquid markets

- Enabling moderately high leverage

- Keeping the contract mark price close to the fair asset price at all times

- A robust liquidation engine that protects against insolvency and socialized losses

- Offering the lowest trading costs (at the application and protocol level)

- Low latency trading

- Supporting a variety of convenient and stable collateral types

- Cross-margining positions

- Ability to offer synthetic exposure to arbitrary assets and contracts

- True on-chain decentralization, or at least full transparency

In our view, the best way for a synthetic DeFi platform to attract liquidity is to optimize for the ten features listed above. However this is complex and there are many tradeoffs that must be considered.

Overview of Major Synthetic Protocols

There are a handful of DeFi constructions available today to produce synthetic financial constructions. Each has pros and cons.

Maker, Kava, BitShares - Collateral backed assets + oracle

In this construction, users withdraw debt against a pool of assets. The debt is synthetic. In order to manage creation, redemption and liquidations, the system requires an external oracle. This is the simplest synthetic asset construction. Both Maker and BitShares employ this model. Protocols which use small market cap assets with thin trading volumes as collateral (Synthetix, BitShares) must require higher collateralization ratios to compensate for volatility risk.

- Pros: simple, concentrates liquidity.

- Cons: not capital efficient, limited leverage available, requires external oracle, unable to maintain peg because of lack of arbitrage loop.

UMA - Priceless contracts

This is similar to the construction above in that traders deposit collateral and withdraw synthetic positions against the collateral. However, the priceless contract construction differs in a few ways: 1) positions don’t have to be fully collateralized, 2) the use of an external oracle is replaced by a crypto-economic game that incentivizes traders and liquidators not to lie about the price of the assets. This model is pioneered by UMA.

UMA provides a general framework for instantiating contracts and resolving price disputes. However, UMA is not a product. There are a handful of teams building products and services on UMA including Potion, and Jarvis.

- Pros: more capital efficient, generalizable to almost any asset, debt exposure is limited to one collateral pool.

- Cons: oracle game theory is new and untested, oracle is slow and cannot be used for realtime cascading liquidations, liquidity is fragmented.

Augur, Gnosis, Polymarket, Flux - Prediction markets

Prediction markets provide the ability to speculate on the outcome of a future event. The most common example is binary options: sports, politics, end of month/quarter/year price predictions. For example: “Will the price of TSLA be higher than $2,000 when the market closes on December 31st, 2020?” Augur, Gnosis, Polymarket, and Flux have adopted this model.

- Pros: capital efficient, optimized for events like politics, sports, and EOY price predictions.

- Cons: requires an external oracle, hard to construct a simple synthetic asset that mirrors 100% of price movements in the underlying, limited and relatively inflexible leverage, less liquidity concentration.

Opium - Dated cash-settled futures

In this model, traders post margin to a smart contract and then buy or sell a futures contract that settles at some specified time. The futures price will converge to the underlying index price at settlement because there’s an arbitrage to buy spot and sell futures or vice versa. Opium uses this model for their futures contracts. This model is very similar to traditional futures contracts in old world financial markets.

- Pros: simple to understand, capital efficient, offers lots of leverage, allows options market makers to hedge their positions, allows miners to lock in hedge durations

- Cons: fragments liquidity across different expiries, requires an external oracle, doesn’t necessarily track the index price for the duration of the contract.

Synthetix - Debt pool based perpetual swaps

Perpetual swap traders trade against the SNX debt pool. As such, unlike in the traditional perp model, traders don’t need to wait for a counterparty to match their trade. Longs and shorts are not always balanced, meaning that excess funding is paid to SNX stakers to compensate for the risk that one side of the trade is more profitable than the other side. Only traders who increase the skew between longs and shorts pay trading fees.

- Pros: Traders don’t need to wait for counterparties, offers lots of leverage, guarantees liquidity, doesn’t require makers, easy to bootstrap liquidity

- Cons: Capital inefficient, SNX stakers are on the hook if traders are profitable

Perpetual Protocol - Perpetual Swaps on a Virtual Automated Market Maker (vAMM)

Traders deposit collateral into a smart contract. They trade a synthetic asset up and down a bonding curve, for example the xy = k curve that Uniswap popularized. The funding rate is determined by the delta between the mark price and the index price set by an external oracle. k is set algorithmically as a function of trading volumes, open interest, and other variables. Note that in this model, there are no makers; everyone is a taker. Perpetual Protocol adopts this model.

- Pros: simple to understand, capital efficient, offers lots of leverage, guarantees liquidity, concentrates liquidity, doesn’t require makers, easy to bootstrap liquidity.

- Cons: requires an external oracle to determine the funding rate, requires a well-capitalized insurance fund.

DerivaDEX, dYdX, MCDEX, Serum - Perpetual Swaps on a Central Limit Order Book (CLOB)

Traders deposit collateral into a smart contract. Liquidity providers post limit orders on the CLOB, and takers cross the spread. DerivaDEX, dYdX, and MCDEX adopt this model with an off-chain CLOB that settles on Ethereum. Project Serum adopts this model with an on-chain CLOB that settles on Solana.

- Pros: simple to understand, capital efficient, offers lots of leverage, offers the tightest spreads, concentrates liquidity.

- Cons: difficult to bootstrap liquidity because it requires sophisticated market makers, requires a well capitalized insurance fund, requires an external oracle to determine the funding rate.

Exploring Non-Custodial Perpetual Swaps

In examining the various types of synthetic constructions in DeFi, we believe that the perpetual swap contract—AMM, debt pool, or order book—is the best design for a decentralized exchange. Perps allow for financial contracts that mirror the underlying very closely, offer ample leverage, are already widely used and understood in crypto and traditional asset classes, and can support any asset with a price feed.

While the perpetual swap contract is not perfect, its weaknesses are manageable. Conversely, the weaknesses of the other models are more challenging to overcome: the collateral-backed asset + oracle model is capital inefficient and the debt doesn’t hold its peg well (see DAI and sUSD prices over the last 24 months). Prediction markets are not Delta One. The priceless contract resolution model is too slow today given the risks of cascading liquidations. The dated futures model fragments liquidity across expiries and is better for sophisticated hedging rather than speculating (perps are easier for retail to understand and trade).

Because we believe a perp exchange will be the “winning” construction in the decentralized exchange sector, below we examine the trade-offs for non-custodial perpetual swaps.

Safety vs. Liquidity/Leverage

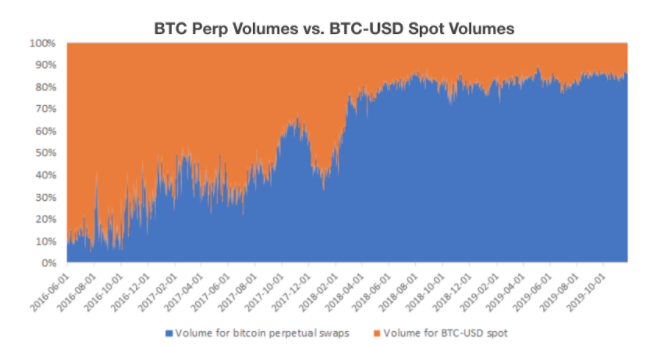

The most important tradeoff is between safety and liquidity/leverage. We say liquidity/leverage because the data shows that platforms that offer more leverage have more volume and liquidity:

Source: Interdax, Tradingview

Source: Interdax, Tradingview

An important consideration for the safety vs. liquidity/leverage trade-off is a platform’s loan to value ratio (LTV) requirements. On MakerDAO and Compound, a user can only attain 66% LTV (1.5x collateralization), whereas BitMEX users can get 10,000% LTV (100x leverage aka 1% collateralization).

Lower LTV affords more safety, but also restricts leverage and therefore reduces liquidity.

There is no “right” answer when it comes to these tradeoffs. An exchange that optimizes too much for safety will be too capital inefficient and illiquid to compete. An exchange that optimizes for too much leverage may be too dangerous to trade on.

At the very least, centralized cryptocurrency exchanges are able to offer 3-10x leverage with relatively low liquidation risk on liquid underlyings; restricting below that significantly increases capital requirements.

While this is phrased in terms of futures leverage, LTV (loan to value ratio) is an analogous parameter for deliverable spot margin trading (e.g. Compound, Aave).

POOLED COLLATERAL VS. ISOLATED MARKETS

One of the key differences between UMA and Synthetix is that collateral and debt exposure are isolated in UMA, whereas they’re pooled together across all LPs in Synthetix. For example, all SNX stakers in the Synthetix ecosystem are on the hook for losses if any synthetic token trader is profitable. The fact that all Synths are all backed by a single collateral pool affords greater liquidity and collateral efficiency but it also means that the entire system could become insolvent if a single trader is wildly profitable.

UMA chooses to isolate collateral per market. This means that if a trader wants to trade across many different UMA markets, they need to post collateral in each one. This creates significant friction, which reduces liquidity. On the other hand, this means that traders only need to underwrite the risk of the market they are trading in as opposed to a global liquidity pool that spans hundreds of assets.

There are also potential capacity tradeoffs here. Cross margined markets need to coordinate risk, limiting the ability for a trader to trade on both in parallel and so limiting effective order throughput. This choice is a fundamental tradeoff, and there is no grey area. Either a protocol allows pooled collateral or it doesn’t. The choice is binary.

SUPPORTING MANY TYPES OF COLLATERAL

Supporting more types of collateral means that traders can more easily trade without the friction of having to acquire new assets for collateral. But also it means that other traders must assume the risk of additional collateral types. If the value of new forms of collateral decreases, the whole system could become insolvent.

dYdX chose the safest option and only allows for a single type of collateral: USDC. On the other hand, MakerDAO allows more types of collateral, and therefore the system offers leverage to a broader universe of traders. However, this also increases the risk of the system becoming insolvent as it did on March 12th.

On the other end of the spectrum, older exchanges like BitMEX and FTX supported multiple types of collateral. Each subaccount also has one central collateral pool and that capital is used to cross margin positions. Today, hedged positions on the same underlying don’t reduce collateral requirements (eg no netting of offsetting positions). However, we expect teams will look to do this over time, either using an internal calculation agent or leveraging a tool like X-Margin.

One strategy to safely support many types of collateral is to put governance restrictions on the maximum percentage of the collateral pool one asset can be. Protocol designers can also require higher collateralization ratios for more volatile assets.

In addition, different forms of collateral carry different amounts of risk. Using stablecoin collateral (like dYdX) is generally the safest and so allows for the most leverage. Using a single liquid asset—like Maker previously did (ETH) can multiply the damage to the system during a large crash. Using a less liquid protocol token like Synthetix does (SNX) is dramatically riskier because of the potential for an idiosyncratic crash in the collateral token, and so it often requires substantially higher collateral levels.

AGGRESSIVENESS OF LIQUIDATIONS

A more aggressive liquidation engine will more effectively preserve the insurance fund, capitalize the insurance fund over time, and protect winning traders. A less aggressive liquidation mechanism is less painful for liquidated traders because they will preserve more of their capital.

A more aggressive liquidation engine will fully liquidate positions immediately when the liquidation price is reached while a less aggressive one will only partially liquidate positions (commonly known as incremental liquidations). For example, FTX executes incremental liquidations whereas Binance executes full liquidations. This can make a huge difference for a trader. For example, if a trader has the same 20x leveraged position on BitMEX vs Binance then BitMEX would liquidate her collateral down to her maintenance margin, while Binance would wipe out her entire position.

A less aggressive engine will liquidate when a trader is closer to their bankruptcy price while a more aggressive engine will liquidate a trader sooner. For example, Synthetix liquidates traders when they get below 200% collateralization. Maker liquidates traders with ETH collateral when they fall below 150% collateralization.

More aggressive liquidation engines can cause cascading price movements. For example, on March 12th, BitMEX’s liquidation engine crushed the price of BTC. During that day BitMEX liquidated more than $1.6B from the long side of the order book. Had BitMEX not allegedly “gone down for maintenance,” their liquidation engine would have likely pushed the price of BTC on BitMEX down to $0.

The best way to measure the aggressiveness of the liquidation engine is to see how long it will hold on to a liquidated position before taking liquidity off the book and pushing the price.

Larger liquidation fees and a more aggressive liquidation engine disincentivize traders from taking on excessive leverage, and thus reduce the amount of liquidations. This means that a venue will be less liquid, and therefore will be more expensive to trade on for makers and takers. But it also means that the exchange will be safer for profitable traders, and it is less likely that the exchange will clawback winnings.

Flexibility vs. Simplicity

The second broad category of tradeoffs is between flexibility vs. simplicity.

BET AGAINST THE HOUSE VS. BET AGAINST OTHER PLAYERS

In some protocols, like Synthetix, all traders are betting against the house. In other protocols, like Serum or DerivaDEX, traders are betting against each other.

This means that the whole Synthetix protocol can become unbalanced when there is more capital going long than short or vice versa. In an extreme example, if 100% of traders on Synthetix are long BTC-USD and there is a gap up in the BTC-USD price, the entire Synthetix protocol could become insolvent!

This type of asymmetric risk on the insurance fund means Synthetix must require higher collateral ratios and have a more aggressive liquidation engine than systems where traders bet against other players.

On the other hand, protocols where traders bet against the house have an easier time kickstarting liquidity because the house provides the supply side of the two-sided market. On a protocol like DerivaDEX or Serum, traders need someone to match their order or they cannot trade. This advantage to bootstrap liquidity can be valuable in the early days if professional market makers are not willing to provide liquidity on the protocol.

ORDER BOOK VS. AMM

AMMs allow liquidity providers to set it and forget it. Order books allow liquidity providers to have more flexibility over where they provide liquidity.

AMMs allow latent capital that doesn’t have the sophistication to be a market maker to quote prices in both directions using a formula rather than allowing each liquidity provider to set prices manually. Importantly, the formula itself is 100% open. And in exchange for contributing capital, liquidity providers collect trading fees. Because the AMM formula is always 100% open, sophisticated market makers can see what the price will be and choose to quote tighter spreads 100% of the time. As such, order books will always be more liquid on high volume assets that market makers are willing to provide liquidity for.

AMMs are primarily useful for long tail assets: assets that are too small for more sophisticated market makers to care about.

SLOW VS. FAST FUNDING

The frequency of expirations or funding payments can affect how closely the contract price tracks the index price. More frequent expirations will mean the contract more closely tracks the index price because it will settle to that price sooner, but this also means that traders need to roll more frequently. More frequent funding payments have the same effect because traders will show up to collect the funding payment and push the contract price back into line but they can be computationally expensive.

Oracles

ORACLE SAFETY VS. ORACLE SPEED

Some derivatives protocols such as UMA and Augur have oracle dispute resolution built in. This can make the protocol safer against oracle failures but it increases the time that traders have to wait to withdraw their money from the exchange. This is a fundamental trade-off between risk of oracle failure and liquidity risk. If an oracle fails and there is no built-in dispute resolution, winning traders have no recourse. But if there is a dispute process, collateral is locked regardless of whether there is a dispute or not and the winning side can not withdraw their capital. This opportunity cost means traders are less likely to trade on the venue.

For example, the oracle dispute period in Augur is 24 hours. This means that winning traders cannot get paid until 1 day after the conclusion of an event.

On the other hand, Synthetix uses Chainlink as its oracle and allows traders to cash out instantly. If the Chainlink oracle was compromised, there would be no recourse for the traders harmed by the oracle failure.

MAXIMUM ORACLE MOVEMENT

Some protocols limit how much the oracle price can move in a certain period of time. This can increase safety in a scenario where the oracle is compromised and the price is moved in a way to unfairly liquidate traders. But if the price does move a lot and the oracle doesn’t, that can cause material market distortions that could materially threaten the solvency of the system.

Decentralized vs. Centralized

Decentralization is not a binary attribute; rather, it is a spectrum. Teams building decentralized exchange protocols must make several choices to determine where they end up on the spectrum.

ON-CHAIN VS. OFF-CHAIN ORDER MATCHING

There are two fundamental ways decentralized synthetics can be traded: on-chain order matching with on-chain settlement, or off-chain order matching with on-chain settlement.

On-chain order matching offers censorship resistance and permissionless access. Off-chain order matching means the operator of the centralized order matching system can (1) change the rules and fees of their order matching system arbitrarily and unilaterally, and (2) censor users or trades.

0x pioneered the off-chain order book concept, and it has been adopted by other protocols such as dYdX. The benefits to an off-chain order book are speed, latency, and costs. An on-chain order book is economically impossible to operate on the Ethereum network—imagine paying $20 to place or cancel an order!

Protocol teams devoted to building on Ethereum have been forced to use off-chain order books, sacrificing censorship resistance and permissionless access in order to be able to function on the extremely constrained Ethereum network.

LAYER 1 VS. LAYER 2

Ethereum network capacity is limited to 15 transactions per second, far too low to support large scale trading activity. This has caused gas fees to spike recently to over 200 GWEI. Additionally, Ethereum blocks clear every 15 seconds on average. Given the nature of PoW mining, this means that trades cannot be considered final for at least several minutes.

A few spot exchanges have already moved to Layer 2 (DeversiFi, Loopring). There is certainly upside to doing this: trades clear faster, transactions are cheaper, and there is less risk of front-running. However, the obvious drawback is that liquidity fragments and these exchanges are not able to take advantage of DEX aggregators (Matcha, 1inch, DEX.ag, etc). It’s impossible for 1inch to partially route an order signed on Layer 1 to a Layer 2 DEX because users must deposit to the Layer 2 exchange first. Additionally, moving to Layer 2 makes it harder for an exchange to support cross-exchange arbitrageurs, as capital needs to first be deposited (slowing down the arbitrage process).

For derivatives exchanges, users must first deposit collateral before they can trade. As such, they don’t particularly benefit from the existing demand-side aggregators. Additionally, forcing users to deposit collateral on Layer 2 instead of on Layer 1 doesn’t really hurt UX. This means that there is not much downside to moving Decentralized FTX's to Layer 2. Thus, we expect that as Layer 2 platforms mature, most perpetual swap protocols being built on Ethereum will eventually move to Layer 2. We believe that there’s simply no upside for them in staying on Layer 1.

ETHEREUM VS. OTHER LAYER 1

There is a clear trade-off between composability and scalability in choosing whether or not to build your perp exchange on Ethereum. Ethereum has the most tradable collateral assets (ETH, USDT, WBTC, etc) and more applications, and thus is better for bootstrapping liquidity.

However, Ethereum Layer 1 cannot support large scale trading activity today. Serum, FTX’s new decentralized derivatives exchange on Solana, has therefore optimized for scalability and latency over composability. It’s not immediately clear to us what will happen first: (1) Ethereum will scale, or (2) robust interoperability will be solved trustlessly across chains.

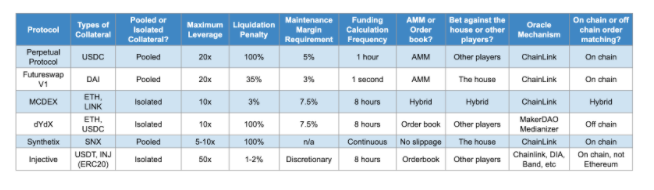

Non-Custodial Perpetual Swap Summary Table

Conclusion

To get a sense of the potential scope of the market size for a decentralized exchange, think about how many trades are economically worthwhile but do not happen because of trust or access issues.

Permissionless access across borders expands access to global financial markets to billions of people around the world who do currently have access. Anyone anywhere in the world will be able to trade any asset they want. This is extremely market expansionary as billions of people come online in the developing world and need access to financial markets.

Decentralized exchanges ensure that no exchange operator or politically motivated regulator can unilaterally change the rules of the exchange – meaning that traders all around the world can be comfortable trading on the same venue.

We believe the decentralized exchange market will be a winner take most market due to the strong network effects of liquidity and reduction in importance of traditional centralized services like customer support, localization, and deposits/withdrawals in a decentralized venue. It’s very important and valuable for teams to get it right early, and to get the flywheel started by attracting liquidity providers and takers. As for the financial tradeoff spectrum covered in this post, we think early winners will evolve over time as they see what is working and what is not.

Multicoin has been looking at early-stage decentralized exchange opportunities for the last 12 months, and we have been actively deploying capital in the space. If you are building a product that aligns with the vision for a decentralized exchange, we would love to hear from you. Please reach out to us at tushar@multicoin.capital and spencer@multicoin.capital.

The original versions of this post cited a "Decentralized BitMEX” and subsequently in September 2020 cited a “Decentralized FTX” as the best representation of our thesis. This post steps away from citing any specific centralized exchange and has thereby been amended to reflect that a "Derivatives DEX" best represents our thesis. Note - although the framing of this post was amended, the data and examples are those originally used in the September 2020 post.

/在 Hotspot 上聆听 Tushar Jain 和 Arman Dezfuli-Arjomandi

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.