Today, DoubleZero (DZ) launched onto mainnet-beta. Multicoin Capital co-led a $28M investment round in DoubleZero earlier this year.

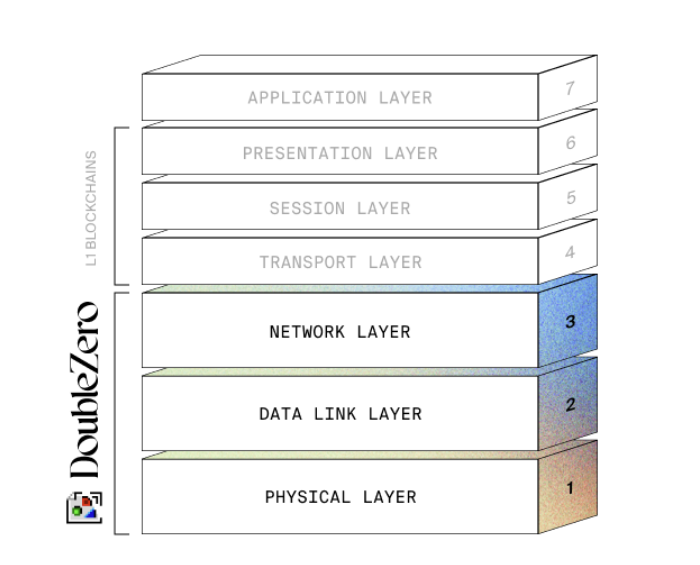

Blockchains are globally distributed systems. The core L1 teams have collectively invested $1B+ over the last decade optimizing networking protocols, consensus, execution, and storage. But there is one layer of the stack they haven’t yet tried to tackle: the physical network layer. Intuitively, this feels out of scope for L1 teams. And yet, in a globally distributed system, the physical network layer is obviously paramount for overall network performance.

DoubleZero is an attempt to accelerate the flow of packets over the physical network layer around the world. How? By creating a permissionless marketplace for high performance network links—AKA dedicated fiber. DZ sits below L1s in the context of the OSI stack.

What’s private fiber?

Broadly speaking, there are two kinds of internet lines around the world: public and dedicated. The vast majority of internet traffic flows over public lines connecting cities, states, and even continents.

Around the 2008-2010 period, trading firms started to realize that the public internet was too slow and unreliable for their latency requirements. And so they began investing in dedicated networking infrastructure to ensure reliable and low latency packet delivery.

Today, the largest trading firms in the world—Jump, Citadel, HRT, Two Sigma, DRW, etc.—all have billions of dollars of customized network equipment spanning many modalities from undersea fiber cables to custom microwave towers that beam radio waves across Lake Michigan. Many of the largest tech companies—Google, Facebook, Microsoft, Amazon, etc.—also have global dedicated fiber connecting their data centers around the world.

DoubleZero is a permissionless network that allows any owner of dedicated network infrastructure—from undersea cables to microwave towers—to contribute access to their un- or under-utilized infrastructure. Previously, only the largest and most sophisticated customers in the world (e.g., HFT firms, Google, Meta) could access dedicated fiber. DoubleZero makes this available to anyone.

The first supplier of bandwidth into DoubleZero is Jump Trading, and the first customer of DoubleZero is the Solana network itself. Galaxy, Distributed Global Technologies, Rockaway X, Cherry Servers, Latitude, South 3rd Ventures, Teraswitch and many, many others have also recently announced they will contribute fiber links to DoubleZero. DZ is integrated into all three major Solana clients: Agave, Firedancer, and Jito. Jito’s block engine has integrated DoubleZero as well.

With DoubleZero powering Solana mainnet-beta, validators will come to consensus faster, data will flow more freely and quickly, and users and market makers will land transactions faster. We believe it’s a win-win for everyone.

Yet DoubleZero is not just for Solana. We expect every major L1 will adopt it in the years to come, as we believe it will be impossible for others to compete with DoubleZero-enhanced networks. Moreover, the network can even serve centralized sequencer L2s by helping them fan out data to various localized RPC servers around the world for latency sensitive applications (e.g. trading).

Looking further to the future, we expect DoubleZero will be adopted beyond core blockchain infrastructure. Any latency-sensitive internet application can be a customer of DoubleZero, and in time we expect that video calling, real-time global augmented reality, and competitive gaming services will all use DoubleZero.

On September 29, 2025 DoubleZero’s prospects for large-scale adoption cleared a significant hurdle when the U.S. Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued a no-action letter (NAL) to DoubleZero, granting relief with respect to certain planned programmatic transfers of the protocol’s native token, the 2Z token (2Z). Users pay fees in 2Z to transmit communications over the network, and a portion of these fees is programmatically rewarded to network providers as compensation for their provision of fiber links and operation of hardware comprising the network. Additionally, resource providers are programmatically compensated with newly minted 2Z for tracking user interactions and payments, calculating network provider fees and otherwise administering the protocol.

The NAL confirms that the Division of Corporation Finance will not recommend enforcement actions for such programmatic transfers of 2Z, thereby confirming that these transactions do not require registration as securities transactions under U.S. federal securities laws. By reducing legal uncertainty, the NAL offers DoubleZero a clear pathway to launch and operate its network today and reinforces the SEC’s continued recognition of responsible innovation in the digital asset space.

Austin Federa and DoubleZero Foundation’s general counsel Mari Tomunen worked with the SEC to achieve this outcome for the network. We’ve known Austin for years, and we were incredibly excited when he told us he was joining forces with Andrew McConnell and Mateo Ward, who have decades of experience building high performance dedicated fiber networks for Jump. We believe that the DoubleZero team is stacked with the best networking engineers, intimate knowledge of high performance blockchains, and an incredible go to market team.

IBRL.

/Creating The World’s Leading Solana Treasury Company

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.