Over the past three years, Multicoin Capital has acquired a significant position in JTO, the native token of the Jito Network, across our hedge fund and venture funds.

An executive summary of our 45 page asset report is presented below. You may download the complete report and analysis, including our valuation model and price target, by clicking the "Read Full Report" button.

Executive Summary

Jito has become an essential component of Solana’s economic machine, and we believe their systems are critical infrastructure for transaction processing and block production across the Solana network. Our conviction in Jito (and its native token JTO) is deeply rooted in the structural lock-in that Jito has created across stakers, validators, frontends, and users, and their dominance in the transaction supply chain. Simply put, it is at the epicenter of a multi-sided network that keeps Solana humming.

Today, Jito is an integrated software system with three core pieces:

transaction processing and block production architecture (i.e., Jito-Solana Validator Client, and affiliated products Relayer, Shredstream, Block Engine, and Bundles), staking architecture (i.e., JitoSOL, Jito’s liquid staking token, and Stakenet, Jito’s autonomous, decentralized stake delegation algorithm), and restaking architecture (i.e., Node Consensus Networks including TipRouter and Vaults).

We have spoken and written extensively about MEV as a framework for valuing asset ledgers. Throughout 2024, MEV capture and redistribution moved up the stack. We expect this trend to continue for the foreseeable future. We view JTO as one of the largest beneficiaries of this movement as crypto market structure matures.

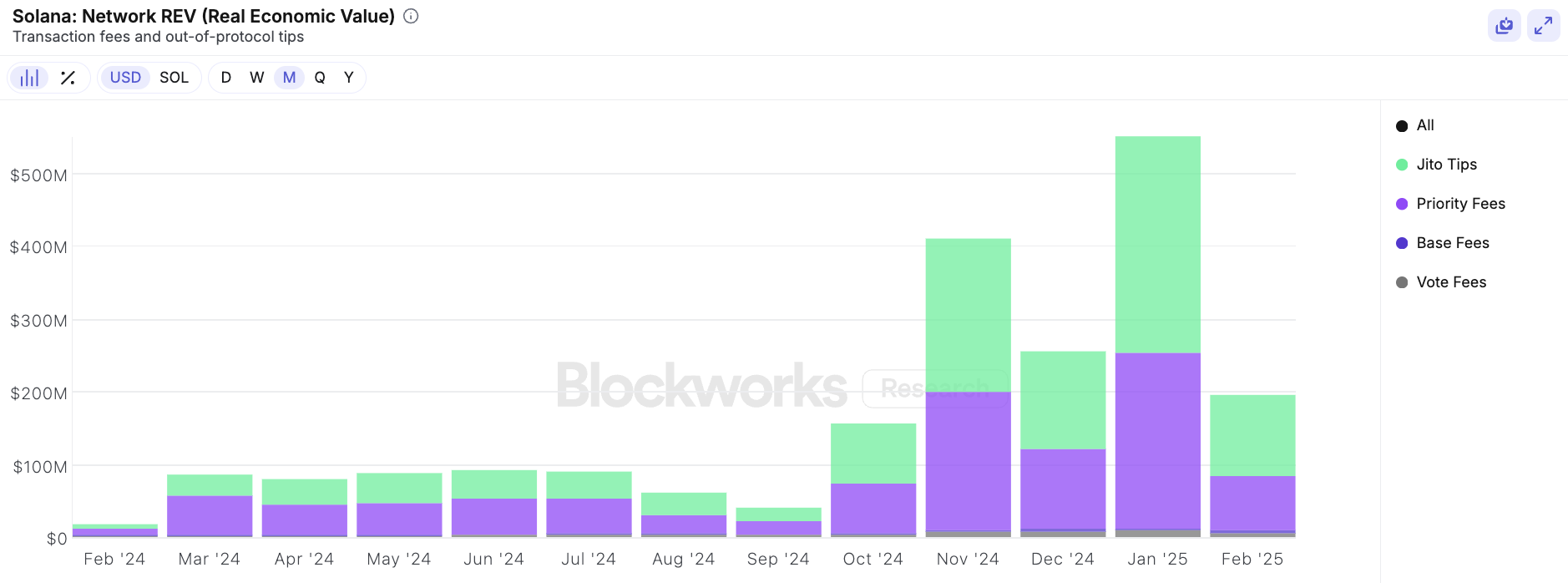

Solana is the most widely used and productive public blockchain network in existence today by a wide margin, consistently surpassing all other major chains on transaction revenue (per Dune Analytics, chart excludes tips) and trading volume (per DefiLlama) starting in Q4 2024. Since then, Solana’s REV (Real Economic Value) has exploded as a function of facilitating billions in volume, and more than half of the transaction fees on Solana are processed through the Jito system.

Source: Blockworks Research, March 3, 2025

Source: Blockworks Research, March 3, 2025

In addition to value capture moving up the stack, we believe JTO represents the best fundamentally-sound, risk-adjusted way to get asymmetric exposure to Internet Capital Markets on Solana.

Transaction execution around hotly contested state is crucial for the functioning of a permissionless, high-performance, distributed asset ledger. The only way Solana achieves its original vision of “blockchain at Nasdaq speed” is by handling extreme amounts of ingress and egress with low latency. Jito plays a critical role in this, segmenting Solana transactions by time preference, while stabilizing the network and preventing congestion that arises from overwhelming demand for transaction inclusion.

The Jito suite of products has been instrumental in preserving user experience on Solana as the system scales. At the time of writing, over 94% of stake on Solana runs the Jito-Solana client, which has provided much needed reliability in landing transactions with consistently low median fees during high volatility events. We believe that this unlocks exponential growth at the application layer — enabling use cases like performant derivatives exchanges capable of prioritizing maker cancels, leading to tighter spreads (Drift), DePINs that rely on low-cost token transfers at scale (io.net, Render, Hivemapper, GEODNET, and Helium), new spot asset issuance and exchange platforms (Jupiter, Clearpools, and Backpack), and more.

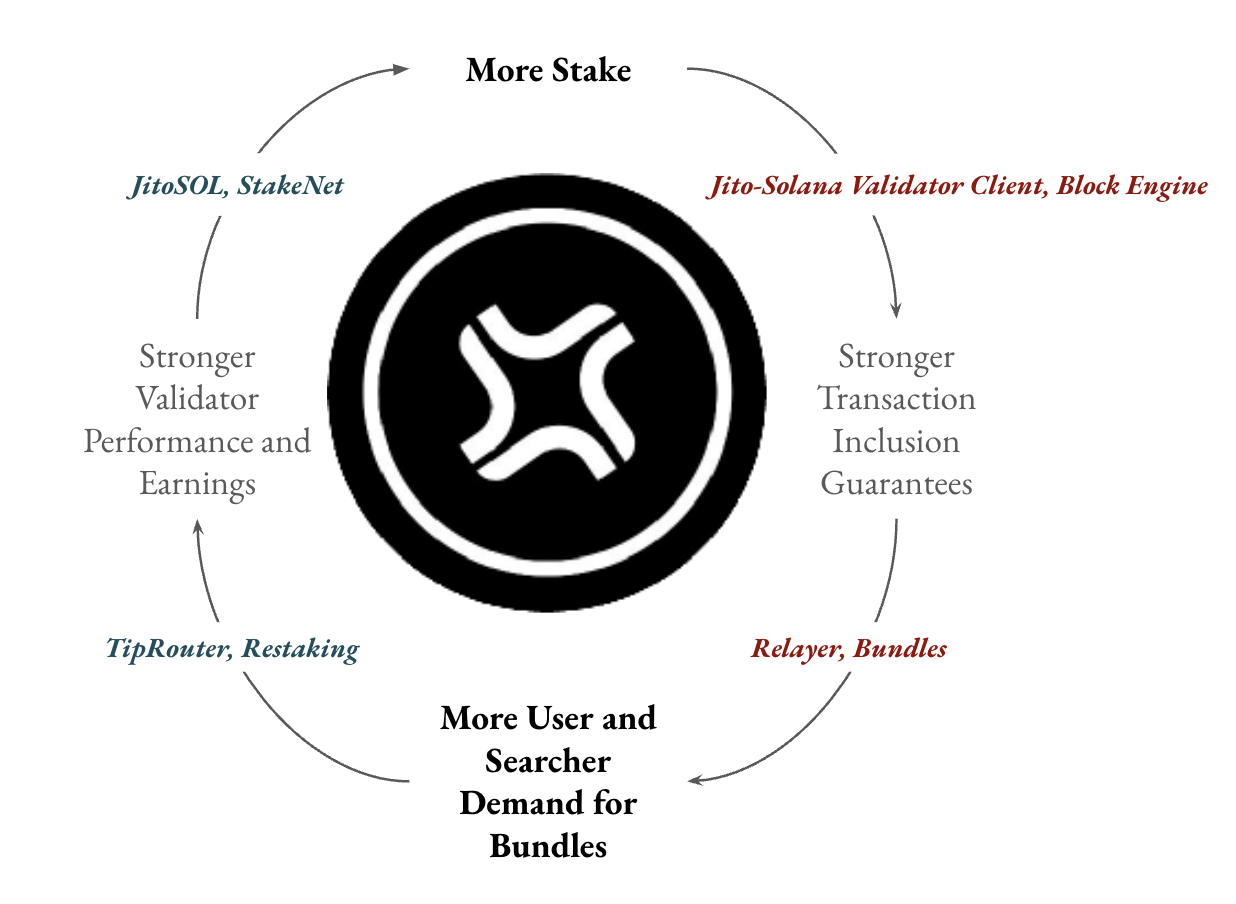

Each of the Jito products reinforces the others. The StakeNet delegation system and JitoSOL stake pool encourage validators to run the Jito-Solana client. Running the Jito-Solana client allows validators to earn and distribute higher rewards to their stakers through more profitable block construction. Restaking helps decentralize reward distribution while adding unique utility for JitoSOL and JTO, further incentivizing use while driving incremental earnings for stakers.

As the beating heart of MEV capture and distribution across Solana, we expect Jito to capture an increasing share of the economic value generated from Solana — bundle tips, staking rewards, and restaking yields provide multiple avenues of value accrual. Our bull-case price target for JTO is $11.63, or 4.43x the 7-day TWAP price of $2.61 as of March 3, 2025 based on the assumptions and model discussed in the Valuation section of this report.

Jito is the primary beneficiary of Solana’s explosive growth, and the ticker is JTO.

Disclosure: Reviewing the assumptions included in the model in our report is important to understanding the basis for our determination of this price target and the potential for outcomes other than the bull-case.

/Where Are All The Robots?

Today, we are excited to announce that Multicoin led an $8M strategic acquisition of GEOD, the native token of the Geodnet Network, from the Geodnet Foundation.

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.