The Filecoin Virtual Machine (FVM) launched on March 14, 2023 (pi day). There is nothing else in crypto quite like the FVM. It allows developers to bind payments and DeFi to real world primitives on the Filecoin network, starting with storage. Over time, we expect the FVM to also allow for direct programmability of bandwidth and compute resources as well.

We initiated a FIL position leading up to the FVM launch. In our research to understand what developers can build with it we discovered what became our first investment in the Filecoin ecosystem: GLIF.

Today, we’re excited to announce that Multicoin Capital has led a $4.5M round in GLIF—the foundational DeFi primitive of Filecoin, and crypto’s first liquid leasing protocol.

The Foundational DeFi Primitive of Filecoin

Today, the primary function of the Filecoin network is file storage. Storage providers (SPs) must pledge FIL as collateral on behalf of their customers.

In order to provide storage, SPs must provide two forms of capital: hardware and financial capital (in the form of FIL). GLIF uses the FVM to create a permissionless market between people who own FIL and SPs who have hardware. GLIF addresses the core capital efficiency problem in the Filecoin ecosystem, similar to the roles Jito and Lido play in their respective ecosystems. Specifically, GLIF allows FIL holders to deposit FIL to a liquidity pool and receive iFIL in return. iFIL operates as a liquid staking token: it accrues rewards from SPs over time. SPs can lease FIL from the liquidity pool to use for pledging based on the amount of collateral they lock in the protocol. After leasing, SPs must make weekly payments back to the pool. These payments serve as the rewards for liquidity providers. The mechanisms employed by GLIF operate like a crypto “lease” because of the complexities of Filecoin’s underlying cryptoeconomics.

Flexible Foundation

An interesting and under-observed aspect of GLIF is the protocol’s ability to deploy several, interoperable capital markets with their own custom assets and rules (today there is just one market). This feature opens the door for GLIF to engage with LPs and SPs in bespoke ways and horizontally scale to fit new use cases as Filecoin matures.

For example, GLIF could deploy a custom pool specifically for lowering the barrier of entry for new SPs joining the network, a stablecoin-based pool that leverages a SP’s storage deal flow as borrowing collateral, and/or a pool that deploys capital to SPs that are storing specific data sets or running specific compute programs. Eventually, we imagine a Filecoin economy where many bespoke pools exist to incentivize niche or specific use cases when it comes to data storage, retrieval, and eventually compute. In this way, GLIF’s architecture is entirely unique and also well equipped to scale alongside Filecoin and the new use cases that will emerge as the FVM matures.

Strong Traction

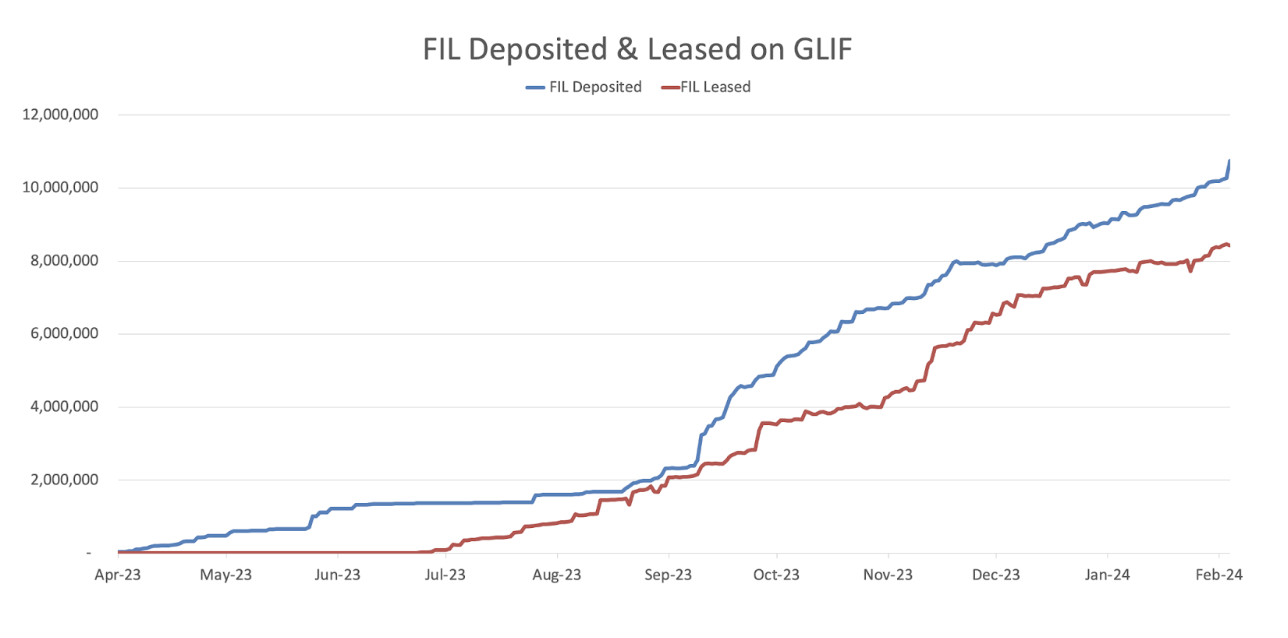

Today, GLIF is the leading DeFi protocol on Filecoin, with roughly 10M FIL being lent, and 8M FIL being leased.

Source: GLIF team

Source: GLIF team

Filecoin Ecosystem Leaders

The GLIF team—led by Jon Schwartz and Peter Andersen—has been building foundational products in the Filecoin ecosystem since 2019. Prior to launching GLIF’s liquid leasing protocol, they built the first web wallet for Filecoin’s Mainnet, the multisig wallet used for Filecoin’s SAFT token distribution (which is still used to this day by Protocol Labs and the Filecoin Foundation to manage payments), the de facto RPC service for Filecoin (has handled over 85 million requests per day!), and several other critical apps and tools for the Filecoin network.

We have loved working with Jon and Peter as they build out the foundational DeFi primitives that will power Filecoin. To learn more about how GLIF’s liquid leasing protocol works, please head to GLIF’s website to learn more about the project and FIL leasing opportunities.

/What Multicoin Is Excited About For 2024

At the end of every year we come together and discuss some of the biggest changes we’re expecting in the year ahead. For the first time, we’re publishing these ideas. Please feel free to reach out to any of us to discuss these ideas further.

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.