Exploring The Design Space of Liquidity Mining

Introduction

Decentralized Finance (DeFi) has recently seen an explosion of activity and public interest. The primary driving factor has been the discovery of “liquidity mining” as a mechanism to bootstrap liquidity. Broadly defined, liquidity mining occurs when users of a DeFi protocol are compensated in that protocol’s native token for interacting with the protocol.

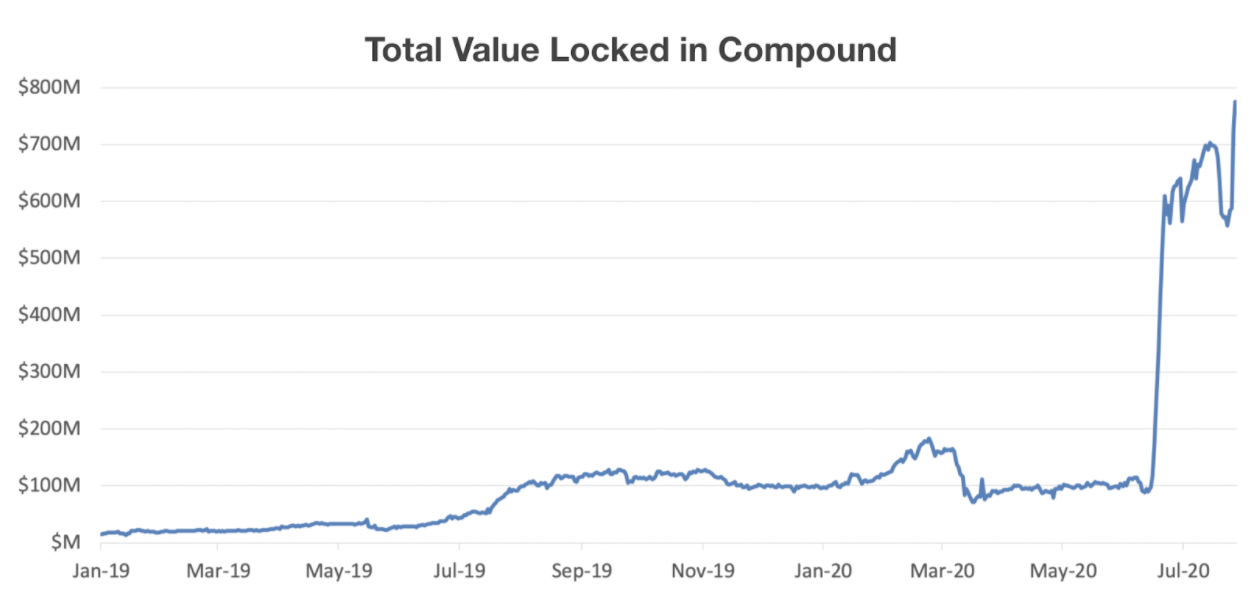

Compound recently launched a high profile liquidity mining program. Under this program, users who either borrow from or lend to the Compound protocol are rewarded with COMP tokens. This increases the return for lenders and subsidizes the rate for borrowers. Immediately after the program launched, it drove a dramatic increase in the borrow/lend activity on Compound.

Source: DeFi Pulse

Source: DeFi Pulse

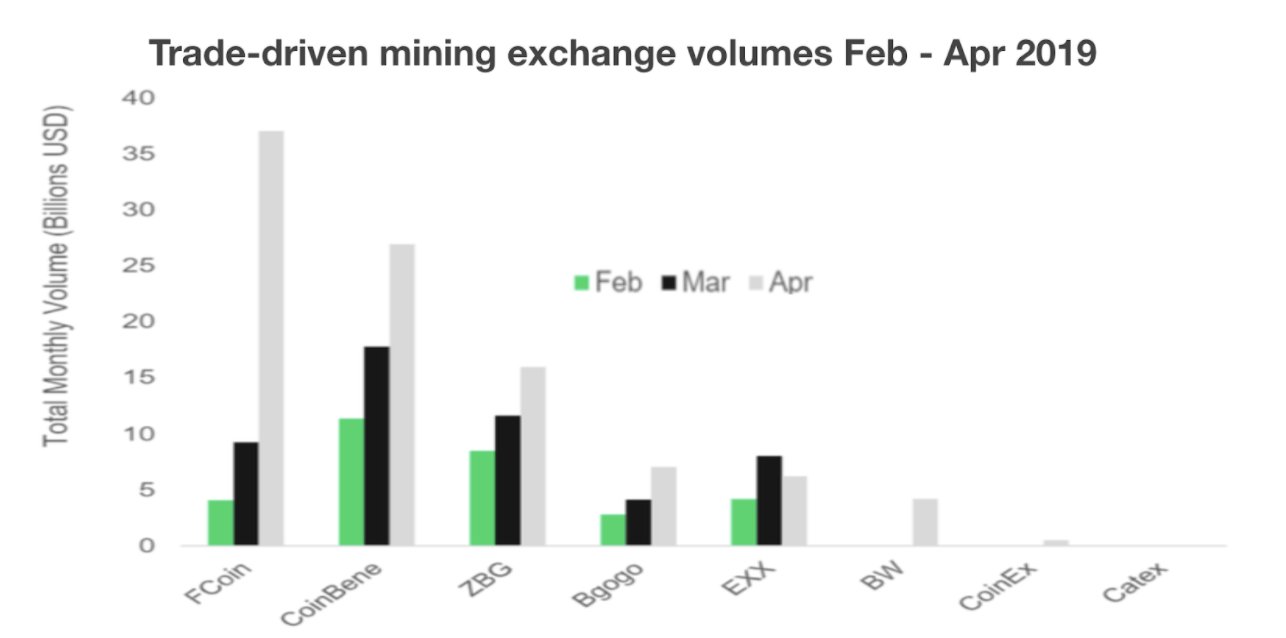

Liquidity mining is an old idea with a new name. In late 2018 several centralized exchange operators in China offered liquidity mining incentives on their platforms. The most prominent of these was an exchange called FCoin.

FCoin offered large incentives to traders who traded on its platform, hoping that the liquidity this created would attract more organic users. FCoin bet that users would stay on the exchange after liquidity incentives ended. They didn’t.

FCoin’s liquidity mining program failed because it had critical design flaws. For background, read this excellent post from Henry He.

Due to the FCoin liquidity mining program, traders started calculating the cost to trade (trading fees) against how much they could earn by selling the mined tokens. The trading rebates were larger than the trading fees, meaning wash trading was profitable. As a result FCoin’s volumes soared—to $5.6B per day—and it appeared to be one of the most liquid exchanges in the world.

Source: CryptoCompare

Source: CryptoCompare

With that being said, it was obvious to most market observers that these volumes were fake and that makers and takers were wash trading to mine and immediately sell FCoin.

We are seeing similar behavior today. For example, once liquidity mining incentives are calculated, Compound pays users a net ~3% to borrow DAI today. Yes, you read that correctly. Instead of paying for a loan, users actually get paid to take out a loan.

While it appears Compound’s liquidity mining program is successful when looking at high level KPIs, it is unclear if their program will be successful in the long run. The Compound team initially designed a liquidity mining system that provided reasonable incentives. However, after a 10x increase in the price of COMP, those same parameters created 50% APY liquidity mining opportunities. This dynamic has disincentivized large users from holding the token: the top 10 COMP liquidity miners are mining more than 70% of COMP, and selling their allocations every 24 hours.

Interestingly, the liquidity mining frenzy may have alienated the true users of the protocol; as arbitrageurs showed up to liquidity mine, it skewed all of the native interest rates of the protocol. So the true user who was borrowing BAT before at a 5% rate was subjected to rates as high as 33% (without accounting for the COMP rewards) when liquidity miners rushed in to borrow BAT.

As soon as the “hot money” loses the incentive to mine COMP, a meaningful percentage of the assets in Compound will flee to more profitable opportunities. This could occur when other opportunities come to market, when COMP mining rewards decrease, or simply when mining profits are arbitraged away. That being said, other opportunities may be capacity constrained or have more smart contract risk. These factors will also be taken into account by liquidity miners.

Ease of capital flight is also likely to accelerate as DeFi yield balancers (dForce’s dtoken, Staked’s RAY, or iearn.finance, etc.) start dynamically reallocating capital to the most profitable yield farming venues. As a result, it’s more important than ever for DeFi projects considering liquidity mining to think carefully about their incentives, and to design their liquidity mining programs to retain capital after get-rich-quick wash traders disappear.

In this essay, we explore the design space of liquidity mining and outline a framework by which DeFi teams can construct a useful liquidity mining program that incentivizes long-term capital retention.

Objectives for Liquidity Mining

The most important step when designing a liquidity mining program is to determine the exact objectives of the program. Some common objectives are:

- Incentivize long term, sticky liquidity.

- Attract a lot of hot money to create momentum and raise awareness about the product.

- Distribute the token without doing an ICO and decentralize governance of the protocol.

Most DeFi teams want to incentivize long term, sticky liquidity. They hope that by giving the users of the protocol an ownership stake in the protocol, those users will stick around. However, not all users are the same and filtering the users who are “hot money” from long term users is the key to successfully accomplishing this goal. There is also little evidence that most users care about governance. While there may be some vocal minority that does, it’s clear that the vast majority would rather optimize profits.

Using liquidity mining as a marketing strategy to attract press coverage and raise awareness is a valid strategy. People need to hear about a product in order to want to use it. But this needs to be carefully managed to ensure that the entire liquidity mining budget isn’t spent on this one goal. In this sense, liquidity mining can be thought of as a marketing campaign. Marketing campaigns are typically time-bound and have clear objectives.

Many protocols imbue their token with governance rights with the goal of decentralizing governance of the protocol. However, if the ownership of a governance token is highly concentrated it is harder to make the case that protocol governance is decentralized. One of the major challenges facing protocol teams is how to distribute their governance token to their users. Liquidity mining can be a powerful tool (among other tools like targeted airdrops) to help solve this problem.

Sometimes these objectives will come in conflict with each other. A team’s ability to define and prioritize their goals when designing their liquidity mining program is paramount to its success.

Exploring the design space

We’ve identified three dimensions that matter when constructing a liquidity mining campaign:

- Who gets paid

- How much they get paid

- When they get paid

Each dimension has its own set of tradeoffs that we explore in the following sections.

WHO GETS PAID

The first question is “who gets paid?” There are three important market participants in most DeFi protocols: (1) makers, (2) takers, and (3) service providers—such as liquidators, keepers, staking nodes, insurance fund stakers, and oracle feed providers. These are the market participants who provide value to the protocols in the form of liquidity and other services.

Incentivizing takers (borrowers) with liquidity mining rewards in lending protocols such as Aave and Compound increases the value of outstanding borrow, and thus increases the cash flow being paid to the protocol. However, this design tends to incentivize wash lending/borrowing and as a result crowds out real organic usage of the protocol by artificially raising the interest rates that organic borrowers need to pay. This was recently observable on Compound. In trading protocols, incentivizing takers can help increase volume and trading fees. But it will contribute to a larger bid-ask spread—thereby hurting organic takers—because it can remain rational for takers to incur more slippage to liquidity mine.

Incentivizing makers with liquidity mining rewards in both lending and trading protocols can be safe, up to a point. If the incentive for makers/lenders is too high, those makers are incentivized to be takers of their own liquidity from another account. The conclusion is that if a protocol wants to prevent wash trading and wash lending, the liquidity mining incentives should not be greater than the fees paid to the protocol.

The category of protocol participants which is most commonly overlooked in liquidity mining programs is service providers. These service providers are critical to the smooth operation of their respective protocols and if they are not adequately resourced it can lead to a significant protocol malfunction such as the one MakerDAO experienced on March 12th. For example, let’s consider the decentralized perpetual swap protocols launching soon Perpetual Protocol, DerivaDEX, Futureswap, Injective, Serum, etc). Incentivizing insurance fund stakers will be critical to attracting liquidity and ensuring traders that they will be paid out on winning trades.

An extremely underexplored avenue of innovation is rewarding users who have been active on competing protocols. For example, if Uniswap was to launch a liquidity mining program for liquidity providers, they could pay a multiplier on rewards for addresses who have been providing X amount of liquidity to Balancer or Curve for Y amount of time. This is akin to centralized exchanges awarding VIP status to traders who have VIP status on other exchanges, or airlines honoring a traveler’s frequent flier status they earned on other airlines. The idea is to poach whales from competing products.

The last dimension to consider when deciding who gets paid is whether to have a retroactive component to the liquidity mining program (paying users who are active before the liquidity mining campaign is announced). The obvious benefit to retroactive incentives is that these users are more likely organic users of the protocol, and are not “hot money” chasing yield. The drawback is that if a percentage of the rewards are given retroactively, it reduces the budget to reward new liquidity and users.

HOW MUCH DO THEY GET PAID

Deciding “how much gets paid” to protocol participants is an important question for all liquidity mining campaigns. There are three vectors to consider: (1) how much gets paid in total, (2) the split between each category (makers, takers, and service providers), and (3) how each category is paid out.

For most crypto protocols, it is desirable for protocol governance to be decentralized and not controlled by a select few insiders. If one of the goals of a liquidity mining program is to distribute tokens for better governance, then more than 50% of the governance tokens should be distributed in a permissionless manner. Over the long-term, a DeFi protocol should hand over governance to the community. And the best way to accomplish that is to get the majority of tokens in the hands of users.

Makers, takers, and service providers are all vital to a healthy DeFi protocol. MakerDAO does not work without lenders, borrowers, and keepers. Some protocols are better served by incentivizing all three types of protocol participants, others should only incentivize two types of participants, or perhaps even just one.

Market makers’ liquidity mining compensation can be calculated using two variables:

- Total dollar value of liquidity provided to a protocol. For example, on an order book exchange makers could be rewarded based on the size of orders they have on the order book, how long they left those orders open, and how close those orders are to the mid price.

- The value of their liquidity that is actually taken by liquidity takers. This is a simple maker rebate.

Takers’ liquidity mining compensation can be calculated based on two variables:

- The amount of volume that they take from a protocol (whether it be trading volume or borrow amount).

- The amount of fees they pay to the protocol or through the protocol to market makers. This is a simple taker rebate.

Lastly, service providers’ compensation can be calculated based on two variables as well:

- The dollar amount of liquidations or keeper transactions that they conduct. This is somewhat accomplished by the incentive mechanisms for liquidations (e.g., Compound liquidators get to buy assets at a 5% discount) but an additional reward in the protocol token can help increase the incentive for more people to be liquidators.

- The amount of value that they reserve for liquidator transactions (e.g., depositing funds in the Mainframe fixed-rating lending guarantor pool), which would help protect against Black Thursday-like MakerDAO events, in which keepers didn’t have enough collateral to quickly execute liquidations and keep the system solvent.

Most of the liquidity mining campaigns we’ve seen thus far pay out a fixed number of tokens across a fixed period of time. We think a more useful design is to compensate users for the actual fees they pay through the protocol or to the protocol. So instead of Compound borrowers receiving a fixed number of COMP per day, they instead receive COMP equal to the USD value of the interest they’ve paid to Compound lenders or the interest rate spread paid to the Compound protocol itself.

WHEN DO THEY GET PAID

Most of the liquidity mining campaigns announced so far do not include lockup or time-based liquidity mining. Because there’s no lock-up, it’s easy for arbitrageurs to determine if they can make profitable trades. For example, Compound borrowers can calculate how much interest they will owe over a 1 hour time period (though admittedly rates can change during that hour). During that hour, they can also approximate how much COMP they’ll generate from liquidity mining at current prices. This wash activity, primarily driven by liquidity mining arbitrageurs, may not be productive for liquidity mining campaign operators who want to grow organic usage.

The way to combat this activity is to delay liquidity mining payments. In the Compound example, if liquidity-mined COMP tokens are locked up for 12 months, there would be no way for arbitrageurs to close the loop without taking on COMP price risk. These traders would then become longer term stakeholders in the Compound ecosystem.

If liquidity mining tokens are locked up, protocol teams can then introduce clawbacks. For example, on Compound, if a liquidity provider earns 100 COMP on Day 1 for providing 30 ETH of liquidity, they could be required to keep at least 15 ETH of liquidity locked up during their token lockup period (12 months in our example). If they fall below that threshold, one half of their liquidity mining rewards from that day could be clawed back into the incentive pool. This idea of a lock-up would be particularly useful for DeFi teams trying to avoid inorganic wash activity that drives out real users.

The other way to approach this (carrot instead of the stick) is to offer a multiplier for users who keep their liquidity in the protocol over time. For example, liquidity providers would get 5 COMP on Day 1, an additional 15 COMP on Day 30 if the same amount of liquidity is still there, and an additional 30 COMP on Day 60. This model would help teams avoid the negative connotation associated with clawbacks or slashing while accomplishing a similar effect.

The last variable teams should consider as it relates to time is how they phase out the rewards. Compound has decided to release COMP linearly for four years, and then end it suddenly. We think that could create some chaos as people flee the protocol at the same time, and liquidity disappears overnight. Instead, teams could slowly phase out the rewards over time. If a team is giving taker rebates, they may offer 100% rebates for the first year, 75% for the second year, and so forth.

Conclusion

The goal of liquidity mining campaigns is to bootstrap network effects. In order to retain users and drive real network effects, teams must consider the structure of their incentives and finetune the variables of their campaigns.

Scanning DeFi Pulse, it’s easy to determine that there are three types of DeFi venues that will likely have large and popular liquidity mining campaigns: (1) Automated Market Maker (AMM) exchanges, (2) lending protocols, and (3) order book exchanges.

Each type of protocol team will have different variables they can tune for their campaigns, but the theme among them will be consistent: if they pay out a fixed number of tokens with no lock-up and no regard for token price to new market participants (not retroactive ones), they should expect short term arbitrageurs to come in and crowd out organic users. For some protocols, that’s okay! If a DeFi team wants big headlines that drive attention, then it makes sense to try and make a splash and bring in short term traders.

But we expect most DeFi teams want to retain users over the long term and distribute tokens to users who will actually participate in governance. Subsidizing illegitimate wash trading is generally a bad allocation of capital/equity for DeFi teams. They’re giving valuable ownership of their networks away to users who essentially offer nothing in return. For these teams, they should consider (1) lockups on mined tokens, (2) rewarding users retroactively, (3) compensating protocol service providers who serve useful functions, and (4) paying “rebates” instead of a fixed amount of tokens with no regards to the USD price of those tokens.

The DeFi sector has just scratched the surface of what is possible with well designed liquidity mining programs. We are excited to watch these programs develop and evolve. If you are building a DeFi protocol with a novel liquidity mining design and want some feedback please reach out.

Thank you to Sam Bankman-Fried and Tony Sheng for feedback on this post.

/Open Audio

Today I’m excited to share that Multicoin Capital led a $3.1M strategic round in Audius alongside our friends at Blockchange Ventures, with participation from Pantera Capital, Collab+Currency, and Coinbase Ventures.

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.