With the growth of the decentralized finance (DeFi) ecosystem over the last 24 months, I’ve been thinking about protocol-level defensibility and market size. I wrote about the former recently. This essay focuses on the latter.

My biggest concern for Ethereum’s current DeFi economy is that it is subject to one or possibly a few invisible asymptotes, as I’ll explain below. An invisible asymptote, per Eugene Wei’s definition, is an invisible ceiling - one that is impossible to measure directly, and is only visible in counterfactual analysis - that restricts growth.

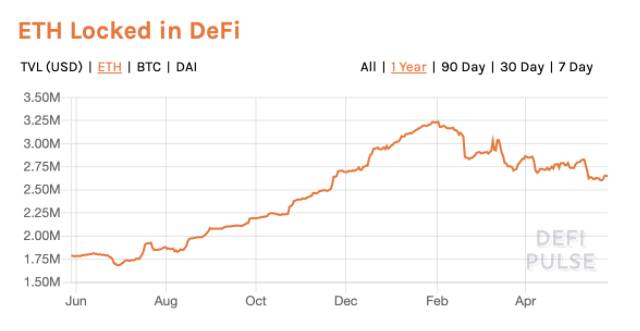

While it’s still too early to tell with certainty, it’s possible that the DeFi ecosystem is already hitting these limits. For example, ETH being used as collateral in DeFi protocols has peaked at around 2-3% of ETH.

In this essay, I’ll assess the strengths and weaknesses of the current DeFi regime against CeFi (centralized finance). Then I’ll attempt to identify some of the invisible asymptotes limiting the growth of DeFi today, and suggest solutions.

DeFi Use Cases

While there are a long tail of use cases for DeFi—no-loss lotteries, prediction markets, staking, identity, and others—there are three major uses for DeFi today:

- Acquiring leverage (e.g. borrowing from Maker, Compound, or margin trading on dYdX)

- Trading (e.g. 0x, Uniswap, Kyber, IDEX, dYdX)

- Getting exposure to synthetic assets (e.g. Synthetix, UMA)

Together, these account for the vast majority of DeFi activity.

Each of these open finance protocols competes with centralized alternatives. To understand the invisible asymptotes, let’s consider the competitive dynamics for each of these use cases.

Acquiring Leverage

For most traders, the two most important features of leverage are the amount of leverage available and cost. Along both of these dimensions, DeFi is worse than CeFi.

- DeFi offers less leverage. The amount of leverage is capped because of latency (15 second blocks). Why does higher latency decrease maximum leverage? Given the volatility and the risk of cascading liquidations coupled with 15 second block times, it’s very difficult to offer highly levered products. dYdX launched BTC perpetual swaps with 10x leverage, but the average use of leverage is 25 - 30x on BitMEX.

- CeFi offers lowering borrowing costs. CeFi companies do this by either extending credit (e.g. banks like Silvergate), through reduced collateral requirements based on trust (e.g. how large lending desks work with trusted clients), or through sheer availability of client deposits (e.g. Binance and Coinbase’s lending desks). While there are certain instances in which DeFi protocols offer lower rates today, these protocols are structurally handicapped. While it’s theoretically possible that traders may begin trading Compound’s cTokens—thereby effectively replicating the advantage that Binance and Coinbase have on their internal ledgers—this fragments liquidity between cTokens and underlying assets.

Can DeFi protocols offer more leverage? Given the volatility of crypto and the current constraints on Ethereum (15 second block times), it’s hard to imagine any platform offering more than 10x leverage, especially in the wake of Black Thursday.

However, Layer 2 solutions such as Skale will offer ~1 second block times, which should mitigate latency (note that the vanilla optimistic roll up architecture does not reduce block times, and therefore does not address this limitation). It’s still unclear if DEXs such as dYdX and traders will move settlement to Layer 2 solutions like Skale.

Can DeFi protocols offer competitive lending rates in the long run? Probably not. I expect the cost of capital offered by centralized financial institutions to collapse in the next few years as more banks (who can extend credit via fractional reserve lending) enter the space. Moreover, because DeFi protocols cannot underwrite trust relationships, they require higher collateralization ratios, further increasing the (opportunity) cost of capital.

For the foreseeable future, I don’t believe that DeFi protocols will be able to outcompete traditional providers of leverage. While DeFi protocols can serve certain customers on the margin that traditional capital providers will not, this market is a fraction of the overall market. The vast majority of market participants want to optimize for cost and availability of leverage, and DeFi protocols struggle to compete with CeFi on both of these dimensions.

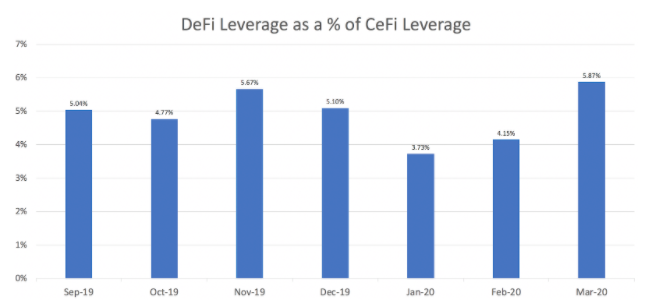

This is clear in the data today. The vast majority of leverage in the crypto ecosystem is from traditional venues.

Sources: DeFi Pulse, Skew

Sources: DeFi Pulse, Skew

It’s worth noting that, if 100% of trading activity moves to a single, public, credibly neutral DeFi standard (e.g. a single Layer 1 as I described a few weeks ago), DeFi can eliminate basis risk, and therefore increase capital efficiency for all market participants. However, this is very unlikely to occur in the foreseeable future.

Trading

There are few major ways in which DeFi protocols are meaningfully worse than their centralized alternatives. Collectively, these have prevented DEXs from taking market share from CEXs.

- Latency and probabilistic finality. Because Ethereum relies on Nakamoto consensus—which only offers high-latency probabilistic finality—makers and takers cannot know their exact positions with 100% precision in real time. Because of this lack of precision, they must be more conservative in trading (e.g., quoting wider spreads). Any solution with faster block times can mitigate this.

- Miner front-running. As the crypto ecosystem matures and traders settle more trades directly on chain, block producers will begin maximizing miner extractable value (MEV). As they do this, they will begin front running trades, which will be especially detrimental to liquidity providers.

- Cross-margining and offsetting positions. Today, Binance and FTX allow traders to cross-margin positions across different types of products (e.g., a long perp swap position to collateralize a call option). In the next year, I expect them to begin to allow offsetting positions as well (e.g., using a short ETH position to allow someone to add more BTC length). I expect the rest of the centralized exchanges to follow. While cross-margining is theoretically possible in a decentralized setting, it’s just much more difficult as decentralized trading venues are much less mature.

- Lack of fiat on ramps. It’s hard to onboard users from fiat to crypto in a decentralized manner in size. There are a few teams tackling this, but no one has cracked it yet. Until then, stablecoins act as a nice stopgap solution for users who are already onboarded.

- Throughput and gas costs. Traders want to be able to settle trades, re-adjust collateral, and make new trades quickly. These computations consume a lot of gas.

Can DeFi protocols reduce latency and offer faster finality? On a low latency Layer 2 such as Skale, or a low latency Layer 1 such as Solana, yes.

Can DeFi protocols mitigate the threat of miner front running? At layer 1, there are some theoretical proposals, but they introduce more latency, complexity, and higher gas costs. In layer 2, with permissioned validators, yes.

Can DeFi protocols bridge the lack of the fiat support? Yes, with stablecoins.

For the foreseeable future, it’s difficult to see decentralized venues overtaking centralized venues. While there are relatively clear forthcoming solutions to address latency and finality concerns, sophisticated traders 1) do not want block producers to front run them, 2) want to be able to cross-margin and offset positions to improve their capital efficiency.

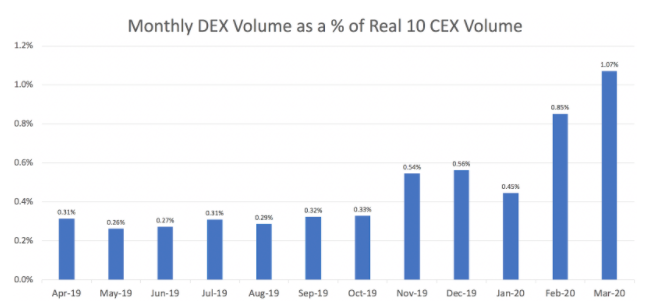

This is clear in the data. The vast majority of trading activity takes place on traditional venues. Virtually all price discovery occurs on CeFi.

Sources: CoinAPI, Bloxy

Sources: CoinAPI, Bloxy

Synthetic Assets

In order to trade synthetic assets, a venue must provide 1) a mechanism to manage collateral and pay out winners/losers, and 2) a reliable price oracle.

Traditional exchanges excel at both of these functions today: they both manage collateral, and they operate centralized price oracles for their perpetual swap contracts (perps). Moreover, FTX has started adding exotic synthetics such as TRUMP and BIDEN contracts for the 2020 US presidential election.

While DeFi protocols can theoretically facilitate arbitrary synthetic contracts (e.g. via Augur), they do not appear to have any execution advantages other than the traits that all DeFi protocols inherit: self-custody and permissionless oracles (which may be a bug rather than feature; this is to be determined).

Centralized exchanges are well positioned to compete in synthetic markets, and they are doing so already via perpetual contracts.

Transcending The Invisible Asymptotes

The most common limitation highlighted above is latency. Latency is paramount because crypto is extremely volatile. When prices can move hundreds of basis points in a matter of seconds, 15-second block times coupled with Nakamoto consensus exacerbate systemic risk.

Centralized finance operates on a timescale measured in nanoseconds. Decentralized finance operates on a timescale measured in seconds. It’s hard to see how DeFi can operate at nanosecond timescale, but using something like Solana - which is the only blockchain that separates global state updates from the progression of time - DeFi can get down to microsecond time scale.

This is concerning for Ethereum 2.0, which will produce new blocks every 12 seconds. DeFi is by far the most important thing happening on Ethereum today, and Ethereum 2.0 is not optimizing for DeFi.

Similarly, throughput is an obvious issue. While on most days, the Ethereum network operates reasonably well, Ethereum faltered on Black Thursday. Ethereum simply cannot process enough transactions. And this is despite the fact that DeFi trading volumes are ~1% of CeFi trading. To put that in perspective, crypto CeFi trading is .1 - 1% of trading across traditional asset classes (excluding FX). DeFi has a long ways to go.

Investing In DeFi

Even while DeFi protocols face structural disadvantages for most users and traders, they still serve certain niches better than CeFi, and some of those niches can be billion-dollar opportunities. For example, I believe there is a large market today for trading non-custodial perps. DeFi perps aren’t going to displace CeFi perps anytime soon because of the reasons highlighted above, but I think that there is some meaningful percentage of the market that would trade on a platform that offers DeFi perps. Given that the market cap of all the major CeFi venues is ~$20B, and that the market is growing quickly, a venue that offers non-custodial perps could be a venture-scale outcome.

As the technical infrastructure underlying DeFi continues to improve, DeFi will begin to take market share from CeFi. At some point in the next 24 months, I expect to see a step function change in DeFi growth rate as all of the requisite infrastructure becomes good enough.

How will everyone know when DeFi has finally won? When price discovery moves from centralized venues to decentralized venues.

If you’re building any novel DeFi protocols, or the infrastructure to power DeFi, please reach out via email or DM me on Twitter.

Thanks to Haseeb Qureshi for providing feedback on this essay.

/Fear, Uncertainty & Doubt in 2020 with Galaxy Digital on Heard Around the Block

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.