Debunking Market Narratives: Litecoin ($LTC) Edition

Narratives are an immensely powerful tool, so much so, that experts generally attribute civilization’s rapid development to humans’ ability to efficiently tell stories. Due to their impact on human behavior, narratives can significantly affect our perception of value. In the current crypto market climate, reality is often overlooked in favor of narrative propagation. As such, it is important to evaluate the accuracy of popular beliefs, and separate the signal from the noise. Let us delve deeper through an analysis of Litecoin.

1. Introduction

Litecoin’s longevity within the crypto-ecosystem is often misconceived as a fundamental indicator of value. Hailed as the silver to bitcoin’s gold, a fundamental store of value, BTC’s testnet and the best medium of exchange in crypto, the market values the network at ~$3 billion.

In truth, Litecoin is a relic of the pre-smart contract platform crypto ecosystem. Perception resulting from these outdated narratives has led to a large divergence between current price and fundamental value. This includes:

- Maturation of the market away from 2017 conditions that facilitated Litecoin’s rally

- Substantial negative catalysts in the near-to-mid term, including additional Coinbase listings, Segwit and Lightning Network adoption reducing the demand for LTC, and lack of material development efforts on LTC

- The Litecoin Foundation has almost no resources, Litecoin development has almost completely stopped, and Litecoin founder Charlie Lee has sold 100% of his LTC stake.

- No sustainable way to fund security of the LTC network over the long term

We will elaborate by providing an overview and background of Litecoin, before analyzing the present narratives and investment thesis, the 2017 rally, and important catalysts in the near-to mid-term that have the potential to distort narratives moving forward.

2. Overview and Background

As the first successfully created altcoin, it is important to understand the historical significance of LTC and the positive and negative consequences of this importance today.

2.1 Founding Litecoin Vision

Prior to Litecoin’s launch, advancements in GPU mining had rendered mining BTC with CPUs unprofitable. Charlie Lee saw this as a shift away from fairness and decentralization. This perceived paradigm shift sparked the development of Litecoin in 2011.

In order to create an altcoin optimized for CPU mining, early Litecoin developers implemented various changes to Bitcoin’s code base. These changes included replacements: (1) Hash algorithm: SHA256 → Scrypt, (2) Block Time: 10 minutes → 2.5 minutes, and (3) Coin Limit: 21 million → 84 million.

Of the changes implemented, the replacement of SHA256 with Scrypt is the most notable. Scrypt is less complex and highly memory intensive. Its simplicity allows for a lower hashrate, while its memory requirement creates additional complexity in the development of mining hardware. As a result, Litecoin mining has been more distributed than Bitcoin mining for most of Litecoin’s existence—up until recently.

2.2 Litecoin Today

Lee’s original vision may have had merit in 2011, but the ecosystem has evolved dramatically since. His initial vision of fairness and decentralization through low barriers to entry mining has ultimately become obsolete. Not only have open-source software developers written GPU mining implementations for Litecoin, but Bitmain has also released Litecoin ASICs. Litecoin mining today is as structurally centralized as Bitcoin mining.

Notably, Lee sold his entire LTC holdings and no longer has any skin in the game. He announced his sales on December 20, 2017, a date on which LTC was trading around $322.

A founder selling their entire holdings is a massive red flag. Lee cited reasons including decentralization, financial distance, and other conflicts of interest for his sale. Despite his intentions, a misalignment of incentives now exists that decreases his motivation to continue development and add value to the protocol. To better achieve this goal, we would have liked to see him time-lock his holdings or use them to fund further LTC development.

3. Litecoin’s Features and Proposed Use Cases

Notwithstanding the current irrelevance of Lee’s original vision, Litecoin’s differences relative to Bitcoin are often cited as comparative advantages that justify Litecoin’s network value. The advantages cited most often include: (1) Increased throughput and shorter confirmation times, (2) lower-fee transactions, (3) eagerness to test and implement new features, and (4) compatibility with BTC and ability to leverage its R&D.

The uniqueness and importance of these features are frequently overstated, which has led to the emergence of 4 distinct narratives: (1) Litecoin as a Medium of Exchange (MoE), (2) Litecoin as a Store of Value (SoV, i.e., “the silver to Bitcoin’s gold”), (3) Bitcoin’s testnet, and (4) Long term viability. Let’s explore each of these in detail.

3.1 Litecoin as a Medium of Exchange

Narrative: Bitcoin’s transaction time and cost will inhibit its adoption as a MoE. On the contrary, Litecoin’s faster and cheaper transactions will lead to adoption by merchants for payments of goods and services.

Analysis: Litecoin is not uniquely positioned to become a MoE and there is no substantial evidence of its adoption. The MoE sector is flooded with competition from well-established projects such as Lightning Network, BCH, and the entire ecosystem of smart-contract platforms.

Litecoin’s adoption is generally shown using qualitative evidence of merchants accepting Litecoin. Merchants accepting Litecoin also generally accept a basket of other cryptoassets because crypto payment processors such as BitPay support many cryptocurrencies. Merchants are not explicitly choosing to support Litecoin payments. Rather, they’re electing to accept payment in any crypto, of which Litecoin is just one.

Further, the Litecoin Foundation’s specific payment processor, Litepay, ceased operation earlier this year in March, thoroughly discrediting this narrative of Litcoin as a superior MoE.

Additionally, Bitcoin’s network traffic and materially higher fees that facilitated LTC’s use as a payment rail in 2017 no longer exist. Bitcoin’s mempool is currently empty, fees are nominal, and confirmation times are reasonable. We believe that the development of Lightning Network, increased SegWit adoption, and other faster/more scalable blockchains will ensure that Litecoin will no longer be an attractive payment rail.

3.2 Litecoin as a Store of Value — “The Silver to Bitcoin’s Gold”

Narrative: As with precious metals, numerous SoVs will coexist, and Litecoin is the silver to Bitcoin’s gold.

Analysis: Comparing digital assets to precious metals may be a nice analogy, but it does not have any substance. The value of the ratio of silver-to-gold is based on the idea of price-to-weight ratio. A lower price-to-weight ratio makes payments for smaller purchases more convenient. Digital assets are weightless, and thus the same analysis cannot be made.

Additionally, if we call Litecoin silver to Bitcoin’s gold, there is no reason why the same could not be said about a multitude of other crypto assets. Lastly, silver retains some value for industrial and jewellery applications. Neither is applicable to crypto. As a SoV in general, Litecoin’s lack of unique features and utility will inhibit it from capturing any meaningful long-term value and will erode this brand position.

3.3 Litecoin as Bitcoin’s Testnet

Narrative: Litecoin plays a valuable role in the ecosystem as a testnet for Bitcoin. Consensus to implement improvements have been easier to achieve on Litecoin, and historically, the Litecoin dev team has been quicker to implement improvements. Examples of this include Segwit and Lightning.

Analysis: While this may be valuable for Bitcoin, citing this as a reason for billions of dollars of value retention is simply nonsensical. Bitcoin simply does not need a separate $3B testnet.

This is not an investment thesis, but a false narrative that has emerged most likely due of the lack of any other viable alternative. Additionally, due to the lack of Litecoin-specific engineering and product development, no one —including the Litecoin bulls—makes the argument that Litecoin will forge some new, independent path.

One common fallacy in crypto is that tokens have value because they have a cost to produce. While this logic is appealing at first glance, it does not actually justify any value. Value is only justified via marginal demand. To make the argument that Litecoin should be valuable as Bitcoin’s testnet, that means that Bitcoin holders must voluntarily choose to sell some Bitcoin in exchange for Litecoin in order to support the testnet to the tune of $3B. This is a ridiculous assertion.

3.4 Viability of Long-Term Security

Narrative: In the future cheap and fast transactions will continue to be sustainable even as block rewards decrease. The protocol can simply rely more heavily on transaction fees to fund security.

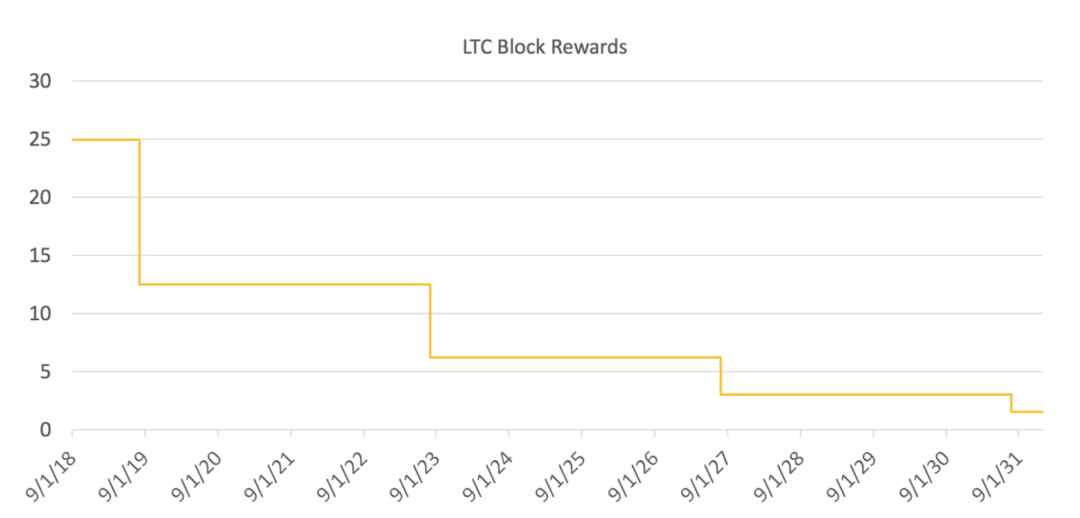

Analysis: Chart 1 shows the decrease in LTC block rewards over time. Today, each LTC block has a 25 LTC reward, equating to a daily security budget of 14,400 LTC (~$750,000). In 2028, according to the halving schedule, each LTC block will have a 3.125 LTC reward (1,800 LTC per day). Excluding transaction fees, the LTC security budget will be cut by 87.5% over the next 10 yrs.

(Chart 1) LTC block rewards over time

While this decrease in the block reward is true for Bitcoin as well, Litecoin claims cheap transactions as a key differentiator while Bitcoin does not. The Litecoin community will have an extremely difficult question to answer: should the Litecoin network allow security to evaporate alongside block rewards, or should it lose the key value proposition of the brand (cheap transactions)?

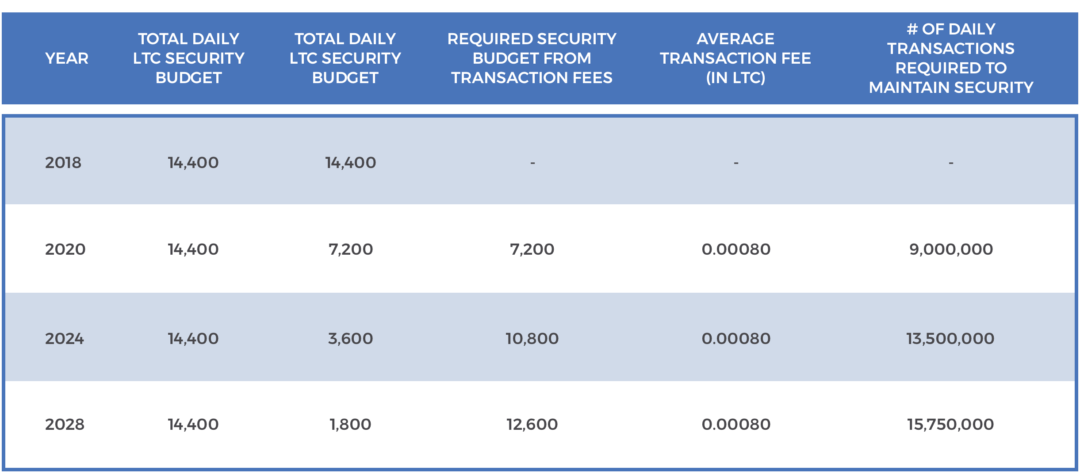

Table 1 below shows the tradeoff more clearly. As block rewards decrease, in order to maintain the security budget and low cost transactions, the number of transactions must increase rapidly. If the Litecoin community wishes to maintain the current narrative of cheap transactions (currently 0.0008 LTC per transaction) the # of necessary transactions to maintain the security of the network will surpass the network’s capacity to process those transactions.

(Table 1) LTC security budget

4. The 2017 Rally

Despite the lack of a viable investment thesis, Litecoin rallied in 2017 along with the rest of the crypto market. This is also important to understand. During the rally, the market experienced exponential growth in consumer and altcoin interest, additional capital for diversification, and demand for a comfortable entry point into the space.

These market conditions existed during a period in which Coinbase was the dominant US exchange, and Coinbase only traded BTC, ETH and LTC during this time. During December 2017 alone, Coinbase users increased 95% to over 4.3 million. As the asset with the lowest nominal price on Coinbase, many naive investors bought Litecoin because they didn’t understand that they could buy a fraction of a $10,000 Bitcoin. As will be discussed in the following section, the market conditions that allowed for Litecoin’s rise no longer exist.

5. Negative Catalysts

We expect multiple strong negative catalysts over the coming months:

- Growth in Coinbase listings rapidly diminishing Litecoin’s position as the comfortable entry point into crypto for naive investors who don’t understand that you can purchase fractional coins

- Increased usability and higher capacity of Bitcoin resulting from Segwit and Lightning adoption

- Viability of Lightning Network as a payment rail

- No differentiated roadmap for LTC

- Persistent selling pressure due to mining

- Bitmain owns over 1M LTC and is likely to sell the LTC to continue their support for BCH

5.1 Coinbase Listings

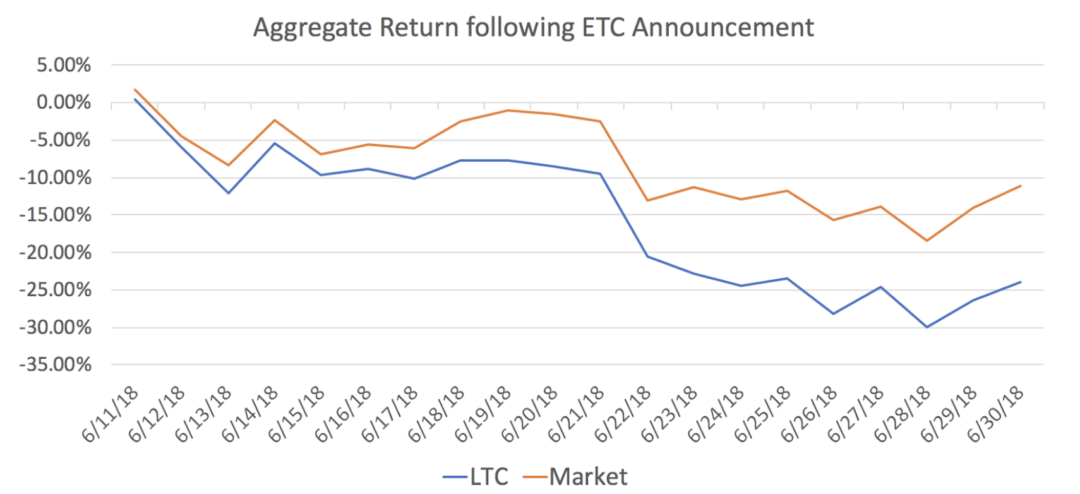

As discussed in section 4, LTC rallied heavily in 2017 as the least expensive per-unit asset on Coinbase. On August 7th 2018, ETC was listed on Coinbase, usurping LTC’s seat as the least expensive per-unit asset. ETC’s listing is a harbinger of increased asset support as Coinbase considers other assets. As the quality, range, and prices of assets listed on Coinbase increases, the demand for Litecoin will decrease simply through dilution of mindshare and an increased number of options.

(Chart 2) LTC Return against market following ETC Announcement (data source)

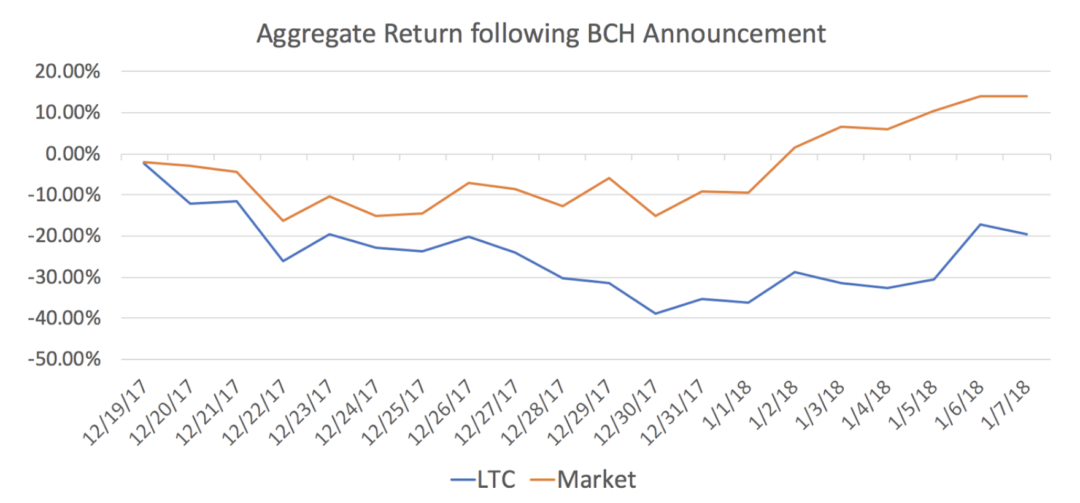

Quantitatively, we can see the effects of Coinbase announcements on Litecoin’s performance. Charts 2 and 3 show Litecoin’s 20-day performance following the announcements of BCH and ETC. LTC underperformed the market by 34% following the BCH announcement and by 13% following the ETC announcement. Given Litecoin’s ~1 market beta over the past 12-months, we can not simply attribute this underformance to Litecoin being more volatile than the market. As Coinbase is one of the largest capital inflows to Litecoin, the expected rapid growth of listings on Coinbase in the near-midterm will likely lead to a decrease in price.

(Chart 3) LTC Return against market following BCH Announcement (data source)

5.2 Bitcoin Usability From Segwit

Bitcoin will become more usable – both in the form of aggregate throughput and lower fees – as Segwit adoption grows and as exchanges roll out Segwit implementations. Coinbase and Bitfinex began their Segwit support earlier this year. Coinbase’s implementation in early March led to a 17% increase in segwit adoption alone. Today, increased adoption has already allowed for persistently low confirmation times and fees. Further integration will continue increase the performance of the Bitcoin network, and consequently will diminish the remaining utility of Litecoin.

5.3 Lightning Network Success

While Segwit adoption has, and will continue to enhance Bitcoin’s efficiency, it has also allowed for the implementation of Lightning. Lightning, which went live in March, has already significantly decreased Bitcoin transaction fees. Currently, there are over 3,000 mainnet Lightning nodes, and capacity expanded 85% in July alone. Lightning’s viability as a payment rail is rapidly gaining traction, and we expect dramatic increases in performance as a result. Additionally, payment rails with Lightning, as well atomic swaps, have paved the way for increased utility and functionality of Bitcoin. We are seeing a dramatic increase in development on this layer, and expect this to continue.

5.4 Lack Of A Differentiated Roadmap

As discussed with the narrative around Litecoin as Bitcoin’s testnet, Litecoin-specific development is sparse. While Litecoin may be willing to implement features more quickly than Bitcoin, Litecoin is not working on anything unique. The latest Litecoin roadmap was posted 11-months ago, and includes: (1) MAST, (2) Lightning Network, (3) Atomic Swaps, (4) Covenants, (5) Confidential Transactions, and (6) Colored Coins. Not one development included in this roadmap is specific to Litecoin, and we have not seen meaningful activity or communication from the Litecoin dev team in 2018. More importantly, the perceived marginal advantages of Litecoin over Bitcoin will continue to diminish over time as Bitcoin implements these same features.

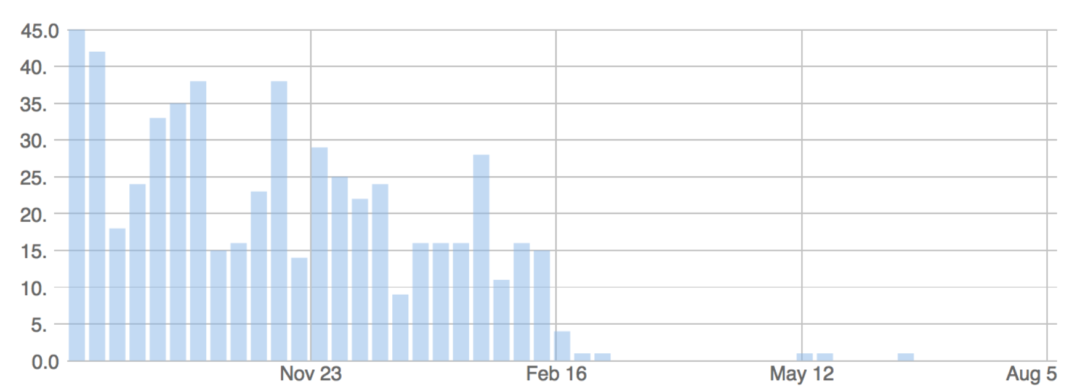

Chart 4 shows the number of Litecoin Github commits over the past 12 months. In 2018, there has been almost no commits at the master. This data is often misconstrued as an indicator of the dev team’s activity. The team does not develop at master, and a new version of core was recently released. We argue that the lack of development at master is a function of the majority of updates being forked from Bitcoin Core and its associated repos. Litecoin may not have been completely abandoned by developers, but there are no new material developments that can be attributed to Litecoin.

(Chart 4) Litecoin Github Commits (data source)

On top of this, the Litecoin Foundation’s financial health is at risk, and their ability to continue operating is questionable. Per the foundation’s financials, their assets as of May 31 assets are worth ~$322k. Table 2 shows the breakdown of their assets.

(Table 2) Litecoin foundation financials (data source)

Of this amount, only 1.2% is currently held in cash, and 81.65% of their assets are held in LTC. This does not bode well for the future role of the foundation.

5.5 Persistent Selling Pressure From Miners

LTC, like all cryptocurrencies based on proof-of-work mining, faces perpetual downwards price pressure as miners must sell LTC that they mine in order to pay fiat-denominated expenses. This pressure is attributed to the creation of LTC every block. As discussed previously, the current block reward for mining Litecoin is 25 LTC, and blocks are mined every 2.5 minutes, resulting in 14,400 new LTC being mined across 576 blocks daily. At current prices, miners are mining $750K worth of Litecoin daily. Additionally, during bear markets, miners are more likely to sell their rewards in order to cover operational costs. As marginal demand diminishes, persistent sell pressure from miners will exacerbate price declines given the natural reflexivity of an asset that cannot be valued, but only priced.

This is in addition to the 1M LTC held by Bitmain which may be sold in order to support the BCH price.

6. Summary

In conclusion, the current narratives used to defend Litecoin’s value appear to be fundamentally inaccurate and based on insignificant evidence. To summarize:

- No matter the perceived use case (e.g., SoV/MoE), Litecoin’s features and advantages are not optimized to thrive within crypto’s quickly evolving and competitive landscape.

- Maturation of the market away from 2017 conditions that facilitated Litecoin’s rally will continue to apply downward pressure on price.

- Substantial negative catalysts in the near-to-mid term, including additional Coinbase listings, Segwit and Lightning Network adoption, and lack of any material development on Litecoin are not sufficiently priced in.

Litecoin has traded within a range of $41 and $358 over the past 52 weeks. Hovering at approximately $50, we believe LTC is significantly overvalued. Given the lack of a viable investment thesis, nonexistent positive catalysts and strong negative catalysts, we expect LTC to continue to substantially underperform the crypto market.

Disclosure: Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of Multicoin Capital Management, LLC or its affiliates (together with its affiliates, “Multicoin”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by Multicoin. Multicoin believes that the information provided is reliable and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites.These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and Multicoin takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Multicoin, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by venture funds managed by Multicoin is available here: https://multicoin.capital/portfolio/. Excluded from this list are investments that have not yet been announced due to coordination with the development team(s) or issuer(s) on the timing and nature of public disclosure. Separately, for strategic reasons, Multicoin Capital’s hedge fund does not disclose positions in publicly traded digital assets.

This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by Multicoin. An offer or solicitation of an investment in any Multicoin investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any Multicoin investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party. Valuations provided are based upon detailed assumptions at the time they are included in the post and such assumptions may no longer be relevant after the date of the post. Our target price or valuation and any base or bull-case scenarios which are relied upon to arrive at that target price or valuation may not be achieved.

Multicoin has established, maintains and enforces written policies and procedures reasonably designed to identify and effectively manage conflicts of interest related to its investment activities. For more important disclosures, please see the Disclosures and Terms of Use available at https://multicoin.capital/disclosures and https://multicoin.capital/terms.